STOCK ANALYST K

This blog is for myself and all others who want to learn about financial investment in general. While the focus of blog is on stocks, I would also like to cover: bond, derivative (options, swaps, future and forward), fund, currency, commodity, Treasury bill (risk-free)/bond, speculation, hedge, black-scholes

Friday, March 18, 2011

BOND PRICING

Bond Pricing

PB = Price of the bond

Ct = interest or coupon payments

T = number of periods to maturity

r = semi-annual discount rate or the semi-annual yield to maturity

Example: Price of 8%, 10-yr. with yield at 6%

Coupon = 4%*1,000 = 40 (Semiannual)

Discount Rate = 3% (Semiannual)

Maturity = 10 years or 20 periods

Par Value = 1,000

Sunday, September 19, 2010

BOND CHARACTERISTICS

BOND CHARACTERISTICS

Face or par value

Coupon rate

Zero coupon bond

Compounding and payments

Accrued Interest

Indenture

Treasury Notes and Bonds

T Note maturities range up to 10 years

T bond maturities range from 10 – 30 years

Bid and ask price

Quoted in points and as a percent of par

Accrued interest

Quoted price does not include interest accrued

Figure 10.1 Listing of Treasury Issues

Corporate Bonds

Most bonds are traded over the counter

Registered

Bearer bonds

Call provisions

Convertible provision

Put provision (putable bonds)

Floating rate bonds

Preferred Stock

Figure 10.2 Investment Grade Bonds

Other Domestic Issuers

Federal Home Loan Bank Board

Farm Credit Agencies

Ginnie Mae

Fannie Mae

Freddie Mac

Innovations in the Bond Market

Reverse floaters

Asset-backed bonds

Pay-in-kind bonds

Catastrophe bonds

Indexed bonds

TIPS (Treasury Inflation Protected Securities)

Face or par value

Coupon rate

Zero coupon bond

Compounding and payments

Accrued Interest

Indenture

Treasury Notes and Bonds

T Note maturities range up to 10 years

T bond maturities range from 10 – 30 years

Bid and ask price

Quoted in points and as a percent of par

Accrued interest

Quoted price does not include interest accrued

Figure 10.1 Listing of Treasury Issues

Corporate Bonds

Most bonds are traded over the counter

Registered

Bearer bonds

Call provisions

Convertible provision

Put provision (putable bonds)

Floating rate bonds

Preferred Stock

Figure 10.2 Investment Grade Bonds

Other Domestic Issuers

Federal Home Loan Bank Board

Farm Credit Agencies

Ginnie Mae

Fannie Mae

Freddie Mac

Innovations in the Bond Market

Reverse floaters

Asset-backed bonds

Pay-in-kind bonds

Catastrophe bonds

Indexed bonds

TIPS (Treasury Inflation Protected Securities)

Friday, September 17, 2010

FACTOR MODELS AND THE ARBITRAGE PRICING THEORY

Arbitrage Pricing Theory

Arbitrage - arises if an investor can construct a zero beta investment portfolio with a return greater than the risk-free rate

If two portfolios are mispriced, the investor could buy the low-priced portfolio and sell the high-priced portfolio

In efficient markets, profitable arbitrage opportunities will quickly disappear

*Note: we will explore more of this with derivatives later

Figure 7.5 Security Line Characteristics

APT and CAPM Compared

APT applies to well diversified portfolios and not necessarily to individual stocks

With APT it is possible for some individual stocks to be mispriced - not lie on the SML

APT is more general in that it gets to an expected return and beta relationship without the assumption of the market portfolio

APT can be extended to multifactor models

Arbitrage - arises if an investor can construct a zero beta investment portfolio with a return greater than the risk-free rate

If two portfolios are mispriced, the investor could buy the low-priced portfolio and sell the high-priced portfolio

In efficient markets, profitable arbitrage opportunities will quickly disappear

*Note: we will explore more of this with derivatives later

Figure 7.5 Security Line Characteristics

APT and CAPM Compared

APT applies to well diversified portfolios and not necessarily to individual stocks

With APT it is possible for some individual stocks to be mispriced - not lie on the SML

APT is more general in that it gets to an expected return and beta relationship without the assumption of the market portfolio

APT can be extended to multifactor models

THE CAPM AND THE REAL WORLD

CAPM and the Real World

The CAPM was first published by Sharpe in the Journal of Finance in 1964

Many tests of the theory have since followed including Roll’s critique in 1977 and the Fama and French study in 1992

MULTIFACTOR MODELS AND THE CAPM

Multifactor Models

Limitations for CAPM

Market Portfolio is not directly observable

Research shows that other factors affect returns

Fama French Three-Factor Model

Returns are related to factors other than market returns

Size

Book value relative to market value

Three factor model better describes returns

Table 7.3 Summary Statistics for Rates of Return Series

Table 7.4 Regression Statistics for the Single-index and FF Three-factor Model

The CAPM was first published by Sharpe in the Journal of Finance in 1964

Many tests of the theory have since followed including Roll’s critique in 1977 and the Fama and French study in 1992

MULTIFACTOR MODELS AND THE CAPM

Multifactor Models

Limitations for CAPM

Market Portfolio is not directly observable

Research shows that other factors affect returns

Fama French Three-Factor Model

Returns are related to factors other than market returns

Size

Book value relative to market value

Three factor model better describes returns

Table 7.3 Summary Statistics for Rates of Return Series

Table 7.4 Regression Statistics for the Single-index and FF Three-factor Model

THE CAPM AND INDEX MODELS

Estimating the Index Model

Using historical data on T-bills, S&P 500 and individual securities

Regress risk premiums for individual stocks against the risk premiums for the S&P 500

Slope is the beta for the individual stock

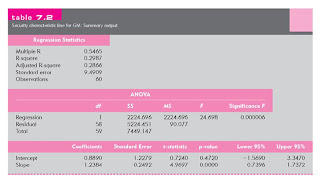

Table 7.1 Monthly Return Statistics for T-bills, S&P 500 and General Motors

Figure 7.3 Cumulative Returns for T-bills, S&P 500 and GM Stock

Figure 7.4 Characteristic Line for GM

Table 7.2 Security Characteristic Line for GM: Summary Output

GM Regression: What We Can Learn

GM is a cyclical stock

Required Return:

rf + b(rm - rf) = 2.75 + 1.24x5.5 = 9.57%

Next compute betas of other firms in the industry

Predicting Betas

The beta from the regression equation is an estimate based on past history

Betas exhibit a statistical property

Regression toward the mean

Saturday, September 11, 2010

THE CAPITAL ASSET PRICING MODEL (CAPM)

Capital Asset Pricing Model (CAPM)

What is CAPM?

It is an Equilibrium model that underlies all modern financial theory

CAMP was derived using principles of diversification with simplified assumptions

Markowitz, Sharpe, Lintner and Mossin are researchers credited with its development

Assumptions

Every financial models have key assumption to ease complexity of real worlds.

Of course there are pros and cons with those assumptions.

CAPM makes a number of assumption,

-Individual investors are price takers

-Single-period investment horizon

-Investments are limited to traded financial assets

-No taxes nor transaction costs

-Information is costless and available to all investors

-Investors are rational mean-variance optimizers

-Homogeneous expectations

Resulting Equilibrium Conditions

All investors will hold the same portfolio for risky assets – market portfolio

Market portfolio contains all securities and the proportion of each security is its market value as a percentage of total market value

Risk premium on the market depends on the average risk aversion of all market participants

Risk premium on an individual security is a function of its covariance with the market

Figure 7.1 The Efficient Frontier and the Capital Market Line

The Risk Premium of the Market Portfolio

M = Market portfolio

rf = Risk free rate

E(rM) - rf = Market risk premium

E(rM) - rf / sim = Market price of risk = Slope of the CAPM

*sim = sigma (std. deviation) of market

Expected Returns On Individual Securities

The risk premium on individual securities is a function of the individual security’s contribution to the risk of the market portfolio

Individual security’s risk premium is a function of the covariance of returns with the assets that make up the market portfolio

Expected Returns On Individual Securities: an Example

Using the Dell example from previous post:

(E(rm) - rf) / 1 = (E(rd) - rf) / Bd

Rearranging gives us the CAPM’s expected return-beta relationship

E(rd) = rf + Bd [E(rm) - rf)]

Figure 7.2 The Security Market Line and Positive Alpha Stock

SML Relationships

b = [COV(ri,rm)] / sm2

E(rm) – rf = market risk premium

SML = rf + b[E(rm) - rf]

Sample Calculations for SML

E(rm) - rf = .08 rf = .03

bx = 1.25

E(rx) = .03 + 1.25(.08) = .13 or 13%

by = .6

e(ry) = .03 + .6(.08) = .078 or 7.8%

Graph of Sample Calculations

What is CAPM?

It is an Equilibrium model that underlies all modern financial theory

CAMP was derived using principles of diversification with simplified assumptions

Markowitz, Sharpe, Lintner and Mossin are researchers credited with its development

Assumptions

Every financial models have key assumption to ease complexity of real worlds.

Of course there are pros and cons with those assumptions.

CAPM makes a number of assumption,

-Individual investors are price takers

-Single-period investment horizon

-Investments are limited to traded financial assets

-No taxes nor transaction costs

-Information is costless and available to all investors

-Investors are rational mean-variance optimizers

-Homogeneous expectations

Resulting Equilibrium Conditions

All investors will hold the same portfolio for risky assets – market portfolio

Market portfolio contains all securities and the proportion of each security is its market value as a percentage of total market value

Risk premium on the market depends on the average risk aversion of all market participants

Risk premium on an individual security is a function of its covariance with the market

Figure 7.1 The Efficient Frontier and the Capital Market Line

The Risk Premium of the Market Portfolio

M = Market portfolio

rf = Risk free rate

E(rM) - rf = Market risk premium

E(rM) - rf / sim = Market price of risk = Slope of the CAPM

*sim = sigma (std. deviation) of market

Expected Returns On Individual Securities

The risk premium on individual securities is a function of the individual security’s contribution to the risk of the market portfolio

Individual security’s risk premium is a function of the covariance of returns with the assets that make up the market portfolio

Expected Returns On Individual Securities: an Example

Using the Dell example from previous post:

(E(rm) - rf) / 1 = (E(rd) - rf) / Bd

Rearranging gives us the CAPM’s expected return-beta relationship

E(rd) = rf + Bd [E(rm) - rf)]

Figure 7.2 The Security Market Line and Positive Alpha Stock

SML Relationships

b = [COV(ri,rm)] / sm2

E(rm) – rf = market risk premium

SML = rf + b[E(rm) - rf]

Sample Calculations for SML

E(rm) - rf = .08 rf = .03

bx = 1.25

E(rx) = .03 + 1.25(.08) = .13 or 13%

by = .6

e(ry) = .03 + .6(.08) = .078 or 7.8%

Graph of Sample Calculations

Thursday, September 9, 2010

RISK OF LONG-TERM INVESTMENTS

Are Stock Returns Less Risky in the Long Run?

Consider a 2-year investment

Variance of the 2-year return is double of that of the one-year return and σ is higher by a multiple of the square root of 2

Generalizing to an investment horizon of n years and then annualizing:

The Fly in the ‘Time Diversification’ Ointment

Annualized standard deviation is only appropriate for short-term portfolios

Variance grows linearly with the number of years

Standard deviation grows in proportion to

To compare investments in two different time periods:

-Risk of the total (end of horizon) rate of return

-Accounts for magnitudes and probabilities

Consider a 2-year investment

Variance of the 2-year return is double of that of the one-year return and σ is higher by a multiple of the square root of 2

Generalizing to an investment horizon of n years and then annualizing:

The Fly in the ‘Time Diversification’ Ointment

Annualized standard deviation is only appropriate for short-term portfolios

Variance grows linearly with the number of years

Standard deviation grows in proportion to

To compare investments in two different time periods:

-Risk of the total (end of horizon) rate of return

-Accounts for magnitudes and probabilities

Subscribe to:

Posts (Atom)