BOND CHARACTERISTICS

Face or par value

Coupon rate

Zero coupon bond

Compounding and payments

Accrued Interest

Indenture

Treasury Notes and Bonds

T Note maturities range up to 10 years

T bond maturities range from 10 – 30 years

Bid and ask price

Quoted in points and as a percent of par

Accrued interest

Quoted price does not include interest accrued

Figure 10.1 Listing of Treasury Issues

Corporate Bonds

Most bonds are traded over the counter

Registered

Bearer bonds

Call provisions

Convertible provision

Put provision (putable bonds)

Floating rate bonds

Preferred Stock

Figure 10.2 Investment Grade Bonds

Other Domestic Issuers

Federal Home Loan Bank Board

Farm Credit Agencies

Ginnie Mae

Fannie Mae

Freddie Mac

Innovations in the Bond Market

Reverse floaters

Asset-backed bonds

Pay-in-kind bonds

Catastrophe bonds

Indexed bonds

TIPS (Treasury Inflation Protected Securities)

This blog is for myself and all others who want to learn about financial investment in general. While the focus of blog is on stocks, I would also like to cover: bond, derivative (options, swaps, future and forward), fund, currency, commodity, Treasury bill (risk-free)/bond, speculation, hedge, black-scholes

Sunday, September 19, 2010

Friday, September 17, 2010

FACTOR MODELS AND THE ARBITRAGE PRICING THEORY

Arbitrage Pricing Theory

Arbitrage - arises if an investor can construct a zero beta investment portfolio with a return greater than the risk-free rate

If two portfolios are mispriced, the investor could buy the low-priced portfolio and sell the high-priced portfolio

In efficient markets, profitable arbitrage opportunities will quickly disappear

*Note: we will explore more of this with derivatives later

Figure 7.5 Security Line Characteristics

APT and CAPM Compared

APT applies to well diversified portfolios and not necessarily to individual stocks

With APT it is possible for some individual stocks to be mispriced - not lie on the SML

APT is more general in that it gets to an expected return and beta relationship without the assumption of the market portfolio

APT can be extended to multifactor models

Arbitrage - arises if an investor can construct a zero beta investment portfolio with a return greater than the risk-free rate

If two portfolios are mispriced, the investor could buy the low-priced portfolio and sell the high-priced portfolio

In efficient markets, profitable arbitrage opportunities will quickly disappear

*Note: we will explore more of this with derivatives later

Figure 7.5 Security Line Characteristics

APT and CAPM Compared

APT applies to well diversified portfolios and not necessarily to individual stocks

With APT it is possible for some individual stocks to be mispriced - not lie on the SML

APT is more general in that it gets to an expected return and beta relationship without the assumption of the market portfolio

APT can be extended to multifactor models

THE CAPM AND THE REAL WORLD

CAPM and the Real World

The CAPM was first published by Sharpe in the Journal of Finance in 1964

Many tests of the theory have since followed including Roll’s critique in 1977 and the Fama and French study in 1992

MULTIFACTOR MODELS AND THE CAPM

Multifactor Models

Limitations for CAPM

Market Portfolio is not directly observable

Research shows that other factors affect returns

Fama French Three-Factor Model

Returns are related to factors other than market returns

Size

Book value relative to market value

Three factor model better describes returns

Table 7.3 Summary Statistics for Rates of Return Series

Table 7.4 Regression Statistics for the Single-index and FF Three-factor Model

The CAPM was first published by Sharpe in the Journal of Finance in 1964

Many tests of the theory have since followed including Roll’s critique in 1977 and the Fama and French study in 1992

MULTIFACTOR MODELS AND THE CAPM

Multifactor Models

Limitations for CAPM

Market Portfolio is not directly observable

Research shows that other factors affect returns

Fama French Three-Factor Model

Returns are related to factors other than market returns

Size

Book value relative to market value

Three factor model better describes returns

Table 7.3 Summary Statistics for Rates of Return Series

Table 7.4 Regression Statistics for the Single-index and FF Three-factor Model

THE CAPM AND INDEX MODELS

Estimating the Index Model

Using historical data on T-bills, S&P 500 and individual securities

Regress risk premiums for individual stocks against the risk premiums for the S&P 500

Slope is the beta for the individual stock

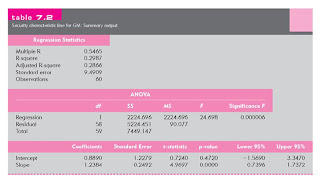

Table 7.1 Monthly Return Statistics for T-bills, S&P 500 and General Motors

Figure 7.3 Cumulative Returns for T-bills, S&P 500 and GM Stock

Figure 7.4 Characteristic Line for GM

Table 7.2 Security Characteristic Line for GM: Summary Output

GM Regression: What We Can Learn

GM is a cyclical stock

Required Return:

rf + b(rm - rf) = 2.75 + 1.24x5.5 = 9.57%

Next compute betas of other firms in the industry

Predicting Betas

The beta from the regression equation is an estimate based on past history

Betas exhibit a statistical property

Regression toward the mean

Saturday, September 11, 2010

THE CAPITAL ASSET PRICING MODEL (CAPM)

Capital Asset Pricing Model (CAPM)

What is CAPM?

It is an Equilibrium model that underlies all modern financial theory

CAMP was derived using principles of diversification with simplified assumptions

Markowitz, Sharpe, Lintner and Mossin are researchers credited with its development

Assumptions

Every financial models have key assumption to ease complexity of real worlds.

Of course there are pros and cons with those assumptions.

CAPM makes a number of assumption,

-Individual investors are price takers

-Single-period investment horizon

-Investments are limited to traded financial assets

-No taxes nor transaction costs

-Information is costless and available to all investors

-Investors are rational mean-variance optimizers

-Homogeneous expectations

Resulting Equilibrium Conditions

All investors will hold the same portfolio for risky assets – market portfolio

Market portfolio contains all securities and the proportion of each security is its market value as a percentage of total market value

Risk premium on the market depends on the average risk aversion of all market participants

Risk premium on an individual security is a function of its covariance with the market

Figure 7.1 The Efficient Frontier and the Capital Market Line

The Risk Premium of the Market Portfolio

M = Market portfolio

rf = Risk free rate

E(rM) - rf = Market risk premium

E(rM) - rf / sim = Market price of risk = Slope of the CAPM

*sim = sigma (std. deviation) of market

Expected Returns On Individual Securities

The risk premium on individual securities is a function of the individual security’s contribution to the risk of the market portfolio

Individual security’s risk premium is a function of the covariance of returns with the assets that make up the market portfolio

Expected Returns On Individual Securities: an Example

Using the Dell example from previous post:

(E(rm) - rf) / 1 = (E(rd) - rf) / Bd

Rearranging gives us the CAPM’s expected return-beta relationship

E(rd) = rf + Bd [E(rm) - rf)]

Figure 7.2 The Security Market Line and Positive Alpha Stock

SML Relationships

b = [COV(ri,rm)] / sm2

E(rm) – rf = market risk premium

SML = rf + b[E(rm) - rf]

Sample Calculations for SML

E(rm) - rf = .08 rf = .03

bx = 1.25

E(rx) = .03 + 1.25(.08) = .13 or 13%

by = .6

e(ry) = .03 + .6(.08) = .078 or 7.8%

Graph of Sample Calculations

What is CAPM?

It is an Equilibrium model that underlies all modern financial theory

CAMP was derived using principles of diversification with simplified assumptions

Markowitz, Sharpe, Lintner and Mossin are researchers credited with its development

Assumptions

Every financial models have key assumption to ease complexity of real worlds.

Of course there are pros and cons with those assumptions.

CAPM makes a number of assumption,

-Individual investors are price takers

-Single-period investment horizon

-Investments are limited to traded financial assets

-No taxes nor transaction costs

-Information is costless and available to all investors

-Investors are rational mean-variance optimizers

-Homogeneous expectations

Resulting Equilibrium Conditions

All investors will hold the same portfolio for risky assets – market portfolio

Market portfolio contains all securities and the proportion of each security is its market value as a percentage of total market value

Risk premium on the market depends on the average risk aversion of all market participants

Risk premium on an individual security is a function of its covariance with the market

Figure 7.1 The Efficient Frontier and the Capital Market Line

The Risk Premium of the Market Portfolio

M = Market portfolio

rf = Risk free rate

E(rM) - rf = Market risk premium

E(rM) - rf / sim = Market price of risk = Slope of the CAPM

*sim = sigma (std. deviation) of market

Expected Returns On Individual Securities

The risk premium on individual securities is a function of the individual security’s contribution to the risk of the market portfolio

Individual security’s risk premium is a function of the covariance of returns with the assets that make up the market portfolio

Expected Returns On Individual Securities: an Example

Using the Dell example from previous post:

(E(rm) - rf) / 1 = (E(rd) - rf) / Bd

Rearranging gives us the CAPM’s expected return-beta relationship

E(rd) = rf + Bd [E(rm) - rf)]

Figure 7.2 The Security Market Line and Positive Alpha Stock

SML Relationships

b = [COV(ri,rm)] / sm2

E(rm) – rf = market risk premium

SML = rf + b[E(rm) - rf]

Sample Calculations for SML

E(rm) - rf = .08 rf = .03

bx = 1.25

E(rx) = .03 + 1.25(.08) = .13 or 13%

by = .6

e(ry) = .03 + .6(.08) = .078 or 7.8%

Graph of Sample Calculations

Thursday, September 9, 2010

RISK OF LONG-TERM INVESTMENTS

Are Stock Returns Less Risky in the Long Run?

Consider a 2-year investment

Variance of the 2-year return is double of that of the one-year return and σ is higher by a multiple of the square root of 2

Generalizing to an investment horizon of n years and then annualizing:

The Fly in the ‘Time Diversification’ Ointment

Annualized standard deviation is only appropriate for short-term portfolios

Variance grows linearly with the number of years

Standard deviation grows in proportion to

To compare investments in two different time periods:

-Risk of the total (end of horizon) rate of return

-Accounts for magnitudes and probabilities

Consider a 2-year investment

Variance of the 2-year return is double of that of the one-year return and σ is higher by a multiple of the square root of 2

Generalizing to an investment horizon of n years and then annualizing:

The Fly in the ‘Time Diversification’ Ointment

Annualized standard deviation is only appropriate for short-term portfolios

Variance grows linearly with the number of years

Standard deviation grows in proportion to

To compare investments in two different time periods:

-Risk of the total (end of horizon) rate of return

-Accounts for magnitudes and probabilities

A SINGLE-FACTOR ASSET MARKET

Single Factor Model

βi = index of a securities’ particular return to the factor

M = unanticipated movement commonly related to security returns

Ei = unexpected event relevant only to this security

Assumption: a broad market index like the S&P500 is the common factor

Specification of a Single-Index Model of Security Returns

Use the S&P 500 as a market proxy

Excess return can now be stated as:

This specifies the both market and firm risk

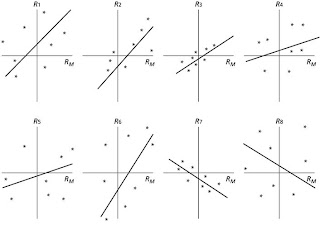

Figure 6.11 Scatter Diagram for Dell

Figure 6.12 Various Scatter Diagrams

Components of Risk

Market or systematic risk: risk related to the macro economic factor or market index

Unsystematic or firm specific risk: risk not related to the macro factor or market index

Total risk = Systematic + Unsystematic

Measuring Components of Risk

si2 = bi2 sm2 + s2(ei)

where;

si2 = total variance

bi2 sm2 = systematic variance

s2(ei) = unsystematic variance

*s=std. deviation

Examining Percentage of Variance

Total Risk = Systematic Risk + Unsystematic Risk

Systematic Risk/Total Risk = p2

ßi2 s m2 / s2 = p2

bi2 sm2 / bi2 sm2 + s2(ei) = p2

Advantages of the Single Index Model

Reduces the number of inputs for diversification

Easier for security analysts to specialize

βi = index of a securities’ particular return to the factor

M = unanticipated movement commonly related to security returns

Ei = unexpected event relevant only to this security

Assumption: a broad market index like the S&P500 is the common factor

Specification of a Single-Index Model of Security Returns

Use the S&P 500 as a market proxy

Excess return can now be stated as:

This specifies the both market and firm risk

Figure 6.11 Scatter Diagram for Dell

Figure 6.12 Various Scatter Diagrams

Components of Risk

Market or systematic risk: risk related to the macro economic factor or market index

Unsystematic or firm specific risk: risk not related to the macro factor or market index

Total risk = Systematic + Unsystematic

Measuring Components of Risk

si2 = bi2 sm2 + s2(ei)

where;

si2 = total variance

bi2 sm2 = systematic variance

s2(ei) = unsystematic variance

*s=std. deviation

Examining Percentage of Variance

Total Risk = Systematic Risk + Unsystematic Risk

Systematic Risk/Total Risk = p2

ßi2 s m2 / s2 = p2

bi2 sm2 / bi2 sm2 + s2(ei) = p2

Advantages of the Single Index Model

Reduces the number of inputs for diversification

Easier for security analysts to specialize

Monday, September 6, 2010

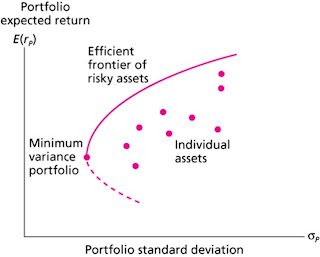

EFFICIENT DIVERSIFICATION WITH MANY RISKY ASSETS

Extending Concepts to All Securities

-The optimal combinations result in lowest level of risk for a given return

-The optimal trade-off is described as the efficient frontier

-These portfolios are dominant

Portfolios Constructed from Three Stocks A, B and C

The Efficient Frontier of Risky Assets and Individual Assets

This graph shows nothing more than an optimal choice.

Given the risk, you will pick the point along the efficient frontier which gives the maximized E(r).

-The optimal combinations result in lowest level of risk for a given return

-The optimal trade-off is described as the efficient frontier

-These portfolios are dominant

Portfolios Constructed from Three Stocks A, B and C

The Efficient Frontier of Risky Assets and Individual Assets

This graph shows nothing more than an optimal choice.

Given the risk, you will pick the point along the efficient frontier which gives the maximized E(r).

THE OPTIMAL RISKY PORTFOLIO WITH A RISK-FREE ASSET

Instead of two risky assets (bond and stock), we can compose a portfolio with one risky and one risk free assets.

Extending to Include Riskless Asset

-The optimal combination becomes linear

-A single combination of risky and riskless assets will dominate

Figure: Opportunity Set Using Stocks and Bonds and Two Capital Allocation Lines

Dominant CAL with a Risk-Free Investment (F)

CAL(O) dominates other lines -- it has the best risk/return or the largest slope

Slope = [ E(ra)-rf ] / std. dev

[ E(rp) - rf ] / std. dev. p > [ E(ra) - rf ] / std. dev.a

Regardless of risk preferences, combinations of O & F dominate

Optimal Capital Allocation Line for Bonds, Stocks and T-Bills

The Complete Portfolio

The Complete Portfolio – Solution to the Asset Allocation Problem

Instead of two risky assets (bond and stock), we can compose a portfolio with one risky and one risk free assets.

Extending to Include Riskless Asset

-The optimal combination becomes linear

-A single combination of risky and riskless assets will dominate

Figure: Opportunity Set Using Stocks and Bonds and Two Capital Allocation Lines

Dominant CAL with a Risk-Free Investment (F)

CAL(O) dominates other lines -- it has the best risk/return or the largest slope

Slope = [ E(ra)-rf ] / std. dev

[ E(rp) - rf ] / std. dev. p > [ E(ra) - rf ] / std. dev.a

Regardless of risk preferences, combinations of O & F dominate

Optimal Capital Allocation Line for Bonds, Stocks and T-Bills

The Complete Portfolio

The Complete Portfolio – Solution to the Asset Allocation Problem

Saturday, September 4, 2010

ASSET ALLOCATION WITH TWO RISKY ASSETS

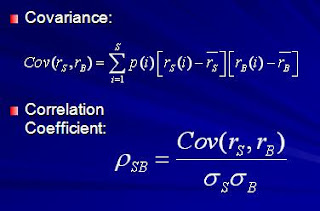

Covariance and Correlation

-Portfolio risk depends on the correlation between the returns of the assets in the portfolio

-Covariance and the correlation coefficient provide a measure of the returns on two assets to vary

Two Asset Portfolio Return – Stock and Bond

Covariance and Correlation Coefficient

Correlation Coefficients: Possible Values

Range of values for r 1,2

-1.0 < r < 1.0

If r = 1.0, the securities would be perfectly positively correlated (meaning two assets move in the same direction)

If r = - 1.0, the securities would be perfectly negatively correlated (meaning two assets move in the opposite direction)

Two Asset Portfolio St Dev – Stock and Bond

In General, For an n-Security Portfolio:

rp = Weighted average of the

n securities

sp2 = (Consider all pair-wise

covariance measures)

Three Rules of Two-Risky-Asset Portfolios

Numerical Example: Bond and Stock Returns

Returns

Bond = 6% Stock = 10%

Standard Deviation

Bond = 12% Stock = 25%

Weights

Bond = .5 Stock = .5

Correlation Coefficient

(Bonds and Stock) = 0

Return = 8%

.5(6) + .5 (10)

Standard Deviation = 13.87%

[(.5)^2 (12)^2 + (.5)^2 (25)^2 + …

2 (.5) (.5) (12) (25) (0)]^ ½

[192.25]^ ½ = 13.87

Investment Opportunity Set for Stocks and Bonds

Investment Opportunity Set for Stocks and Bonds with Various Correlations

-Portfolio risk depends on the correlation between the returns of the assets in the portfolio

-Covariance and the correlation coefficient provide a measure of the returns on two assets to vary

Two Asset Portfolio Return – Stock and Bond

Covariance and Correlation Coefficient

Correlation Coefficients: Possible Values

Range of values for r 1,2

-1.0 < r < 1.0

If r = 1.0, the securities would be perfectly positively correlated (meaning two assets move in the same direction)

If r = - 1.0, the securities would be perfectly negatively correlated (meaning two assets move in the opposite direction)

Two Asset Portfolio St Dev – Stock and Bond

In General, For an n-Security Portfolio:

rp = Weighted average of the

n securities

sp2 = (Consider all pair-wise

covariance measures)

Three Rules of Two-Risky-Asset Portfolios

Numerical Example: Bond and Stock Returns

Returns

Bond = 6% Stock = 10%

Standard Deviation

Bond = 12% Stock = 25%

Weights

Bond = .5 Stock = .5

Correlation Coefficient

(Bonds and Stock) = 0

Return = 8%

.5(6) + .5 (10)

Standard Deviation = 13.87%

[(.5)^2 (12)^2 + (.5)^2 (25)^2 + …

2 (.5) (.5) (12) (25) (0)]^ ½

[192.25]^ ½ = 13.87

Investment Opportunity Set for Stocks and Bonds

Investment Opportunity Set for Stocks and Bonds with Various Correlations

DIVERSIFICATION AND PORTFOLIO RISK

Diversification means reducing risk by investing in a variety of assets. In other words, you are spreading risks among assets. There are two different types of risk in investment.

1. Market risk

-Systematic or Nondiversifiable

2. Firm-specific risk

-Diversifiable or nonsystematic

Market risk is systematic and everyone involved in market must bear it. On the other hand, firm specific can be diversified to some degree.

Here's a figure showing Portfolio Risk as a Function of the Number of Stocks.

As you can see on the B, market risk is fixed at some level and firm-specific adds up.

Portfolio Risk as a Function of Number of Securities

A graph above illustrates that risk (std deviation) declines as the number of stocks in a portfolio increases.

1. Market risk

-Systematic or Nondiversifiable

2. Firm-specific risk

-Diversifiable or nonsystematic

Market risk is systematic and everyone involved in market must bear it. On the other hand, firm specific can be diversified to some degree.

Here's a figure showing Portfolio Risk as a Function of the Number of Stocks.

As you can see on the B, market risk is fixed at some level and firm-specific adds up.

Portfolio Risk as a Function of Number of Securities

A graph above illustrates that risk (std deviation) declines as the number of stocks in a portfolio increases.

Thursday, September 2, 2010

PASSIVE STRATEGIES AND THE CAPITAL MARKET LINE

Average Rates of Return, Standard Deviation and Reward to Variability

Costs and Benefits of Passive Investing

1. Active strategy entails costs: If you pick active strategy, you need constant flow of updated information. This can be very costly. In addition to that, you keep the track of your stocks every hour, minute or even second. Monitoring every movement is time consuming and may need a bunch of staff members to do so. On top of that, you must adapt to changing environment whether it is an external or internal and reevaluate your stocks accordingly.

2. Free-rider benefit

3. Involves investment in two passive portfolios

-Short-term T-bills

-Fund of common stocks that mimics a broad market index

Costs and Benefits of Passive Investing

1. Active strategy entails costs: If you pick active strategy, you need constant flow of updated information. This can be very costly. In addition to that, you keep the track of your stocks every hour, minute or even second. Monitoring every movement is time consuming and may need a bunch of staff members to do so. On top of that, you must adapt to changing environment whether it is an external or internal and reevaluate your stocks accordingly.

2. Free-rider benefit

3. Involves investment in two passive portfolios

-Short-term T-bills

-Fund of common stocks that mimics a broad market index

ASSET ALLOCATION ACROSS RISKY AND RISK-FREE PORTFOLIOS

Allocating Capital

1. Possible to split investment funds between safe and risky assets

2. Risk free asset: proxy; T-bills

3. Risky asset: stock (or a portfolio)

Issues to consider

1. Examine risk/ return tradeoff

2. Demonstrate how different degrees of risk aversion will affect allocations between risky and risk free assets

Example

Total portfolio value = $300,000

Risk-free value = 90,000

Risky (Vanguard and Fidelity) = 210,000

Vanguard (V) = 54%

Fidelity (F) = 46%

CALCULATING EXPECTED RETURN

rf = 7%

srf = 0% (std. dev of risk free)

E(rp) = 15%

sp = 22% (std. dev of portfolio)

y = % in p (risky)

(1-y) = % in rf

E(rc) = yE(rp) + (1 - y)rf

rc = complete or combined portfolio

For example, y = .75

E(rc) = .75(.15) + .25(.07)

= .13 or 13%

Investment Opportunity Set with a Risk-Free Investment

Variance on the Possible Combined Portfolios: Since srf = 0 then sc = y*sp

What it means is that standard deviation of risk free asset = 0. So only variance/std deviation that we should be concerned is risky asset/portfolio. Multiply std deviation of risky asset by the asset's allocation % to get total std. deviation.

Combinations Without Leverage

If y = .75, then

sc = .75(.22) = .165 or 16.5%

If y = 1

sc = 1(.22) = .22 or 22%

If y = 0

sc = 0(.22) = .00 or 0%

Using Leverage with Capital Allocation Line

Borrow at the Risk-Free Rate and invest in stock

Using 50% Leverage

rc = (-.5) (.07) + (1.5) (.15) = .19

sc = (1.5) (.22) = .33

Risk Aversion and Allocation

1. Greater levels of risk aversion lead to larger proportions of the risk free rate

2. Lower levels of risk aversion lead to larger proportions of the portfolio of risky assets

3. Willingness to accept high levels of risk for high levels of returns would result in leveraged combinations

1. Possible to split investment funds between safe and risky assets

2. Risk free asset: proxy; T-bills

3. Risky asset: stock (or a portfolio)

Issues to consider

1. Examine risk/ return tradeoff

2. Demonstrate how different degrees of risk aversion will affect allocations between risky and risk free assets

Example

Total portfolio value = $300,000

Risk-free value = 90,000

Risky (Vanguard and Fidelity) = 210,000

Vanguard (V) = 54%

Fidelity (F) = 46%

CALCULATING EXPECTED RETURN

rf = 7%

srf = 0% (std. dev of risk free)

E(rp) = 15%

sp = 22% (std. dev of portfolio)

y = % in p (risky)

(1-y) = % in rf

E(rc) = yE(rp) + (1 - y)rf

rc = complete or combined portfolio

For example, y = .75

E(rc) = .75(.15) + .25(.07)

= .13 or 13%

Investment Opportunity Set with a Risk-Free Investment

Variance on the Possible Combined Portfolios: Since srf = 0 then sc = y*sp

What it means is that standard deviation of risk free asset = 0. So only variance/std deviation that we should be concerned is risky asset/portfolio. Multiply std deviation of risky asset by the asset's allocation % to get total std. deviation.

Combinations Without Leverage

If y = .75, then

sc = .75(.22) = .165 or 16.5%

If y = 1

sc = 1(.22) = .22 or 22%

If y = 0

sc = 0(.22) = .00 or 0%

Using Leverage with Capital Allocation Line

Borrow at the Risk-Free Rate and invest in stock

Using 50% Leverage

rc = (-.5) (.07) + (1.5) (.15) = .19

sc = (1.5) (.22) = .33

Risk Aversion and Allocation

1. Greater levels of risk aversion lead to larger proportions of the risk free rate

2. Lower levels of risk aversion lead to larger proportions of the portfolio of risky assets

3. Willingness to accept high levels of risk for high levels of returns would result in leveraged combinations

INFLATION AND REAL RATES OF RETURN

Real vs. Nominal Rates

It is an important element to consider in an investment. Unfortunately many people ignore real value of their returns and exclusively focus on nominal value. For instance, your t-bill yielded 3.5% last year but inflation rate for the year was 4%. A dollar invested in the t-bill became $1.035. That sure is increase in nominal value but are you truly better off? Well, no. Because after the inflation, you actually incurred a loss of 0.5%. Compared to last year, you have less purchasing power.

As a shrewd investor, you must take inflation into account and compute real rate of return.

Fisher effect: Approximation

nominal rate = real rate + inflation premium

Note that this is only an approximation and not an accurate formula but it is close enough. So no further complex computation is not needed.

R = r + i or r = R - i

R = nominal and r = real

Example r = 3%, i = 6%

R = 9% = 3% + 6% or 3% = 9% - 6%

It is an important element to consider in an investment. Unfortunately many people ignore real value of their returns and exclusively focus on nominal value. For instance, your t-bill yielded 3.5% last year but inflation rate for the year was 4%. A dollar invested in the t-bill became $1.035. That sure is increase in nominal value but are you truly better off? Well, no. Because after the inflation, you actually incurred a loss of 0.5%. Compared to last year, you have less purchasing power.

As a shrewd investor, you must take inflation into account and compute real rate of return.

Fisher effect: Approximation

nominal rate = real rate + inflation premium

Note that this is only an approximation and not an accurate formula but it is close enough. So no further complex computation is not needed.

R = r + i or r = R - i

R = nominal and r = real

Example r = 3%, i = 6%

R = 9% = 3% + 6% or 3% = 9% - 6%

Wednesday, September 1, 2010

Risk Premiums and Risk Aversion

Risk level of an investor is determined by degree to which investors are willing to commit funds

Risk aversion is how reluctant you are in investing.

If T-Bill denotes the risk-free rate, rf, and variance denotes volatility of returns then:

The risk premium of a portfolio is: E(rp) - rf

In other words, expected return of portfolio minus risk-free rate.

To quantify the degree of risk aversion with parameter A:

The Sharpe (Reward-to-Volatility) Measure

This sharpe ratio is known to be used by mutual/hedge fund managers. This shows how much extra/additional return (excessive return or premium) you are earning when you bear a unit of risk in an investment. The Sharpe ratio has as its principal advantage that it is directly computable from any observed series of returns without need for additional information surrounding the source of profitability.

Risk aversion is how reluctant you are in investing.

If T-Bill denotes the risk-free rate, rf, and variance denotes volatility of returns then:

The risk premium of a portfolio is: E(rp) - rf

In other words, expected return of portfolio minus risk-free rate.

To quantify the degree of risk aversion with parameter A:

The Sharpe (Reward-to-Volatility) Measure

This sharpe ratio is known to be used by mutual/hedge fund managers. This shows how much extra/additional return (excessive return or premium) you are earning when you bear a unit of risk in an investment. The Sharpe ratio has as its principal advantage that it is directly computable from any observed series of returns without need for additional information surrounding the source of profitability.

Risk and risk premium

Risk is uncertainty. When you make an investment, there is always a risk associated with it whether it is a bond, stock, fund, etc. Risk arises from uncertainty. We don't know market direction next year. As a matter of fact, we don't even know how market will drop/raise our stock price tomorrow. Risk can be separated into 2 different types. One is an internal risk. This is also known as a business specific risk, where uncertainty comes from the company and its operation. The other one is a market risk. This is an external risk that you will have to bear.

Scenario Analysis and Probability Distributions

In order to examine risk, we can look at the risk/uncertainty using probability. Here 3 important variables that you need to know before moving on the analysis.

1) Mean: most likely value

2) Variance or standard deviation

3) Skewness

This picture demonstrates famous concept known as "normal distribution." The normal distribution is an absolutely continuous probability distribution whose cumulants of all orders above two are zero. Note that norm. distribution has mean equals to median.

In probability theory and statistics, skewness is a measure of the asymmetry of the probability distribution of a real-valued random variable. skewness value can be positive or negative, or even undefined. Qualitatively, a negative skew indicates that the tail on the left side of probability density function is longer than the right side and the bulk of the values (including the median) lie to the right of the mean. A positive skew indicates that the tail on the right side is longer than the left side and the bulk of the values lie to the left of the mean.

Measuring Mean: Scenario or Subjective Returns

p(s) = probability of a state

r(s) = return if a state occurs

1 to s states

This is a formula to calculate expected return (subjective/scenario return), which is equals to multiplication of each state's probability (in decimal) and return. After you get each value, sum them up to get final E(r) value.

Numerical Example: Subjective or Scenario Distributions

State Prob. of State rin State

1 .1 -.05

2 .2 .05

3 .4 .15

4 .2 .25

5 .1 .35

E(r) = (.1)(-.05) + (.2)(.05)...+ (.1)(.35)

E(r) = .15 or 15%

Measuring Variance or Dispersion of Returns

Variance is used as one of several descriptors of a distribution. It describes how far values lie from the mean.

Var = sum of probability (in decimal) multiplied by outcome of individual return minus average. And Standard deviation is simply a square root of variance.

Using the same example above,

Var =[(.1)(-.05-.15)2+(.2)(.05- .15)2...+ .1(.35-.15)2]

Var= .01199

S.D.= [ .01199] 1/2 = .1095 or 10.95%

Scenario Analysis and Probability Distributions

In order to examine risk, we can look at the risk/uncertainty using probability. Here 3 important variables that you need to know before moving on the analysis.

1) Mean: most likely value

2) Variance or standard deviation

3) Skewness

This picture demonstrates famous concept known as "normal distribution." The normal distribution is an absolutely continuous probability distribution whose cumulants of all orders above two are zero. Note that norm. distribution has mean equals to median.

In probability theory and statistics, skewness is a measure of the asymmetry of the probability distribution of a real-valued random variable. skewness value can be positive or negative, or even undefined. Qualitatively, a negative skew indicates that the tail on the left side of probability density function is longer than the right side and the bulk of the values (including the median) lie to the right of the mean. A positive skew indicates that the tail on the right side is longer than the left side and the bulk of the values lie to the left of the mean.

Measuring Mean: Scenario or Subjective Returns

p(s) = probability of a state

r(s) = return if a state occurs

1 to s states

This is a formula to calculate expected return (subjective/scenario return), which is equals to multiplication of each state's probability (in decimal) and return. After you get each value, sum them up to get final E(r) value.

Numerical Example: Subjective or Scenario Distributions

State Prob. of State rin State

1 .1 -.05

2 .2 .05

3 .4 .15

4 .2 .25

5 .1 .35

E(r) = (.1)(-.05) + (.2)(.05)...+ (.1)(.35)

E(r) = .15 or 15%

Measuring Variance or Dispersion of Returns

Variance is used as one of several descriptors of a distribution. It describes how far values lie from the mean.

Var = sum of probability (in decimal) multiplied by outcome of individual return minus average. And Standard deviation is simply a square root of variance.

Using the same example above,

Var =[(.1)(-.05-.15)2+(.2)(.05- .15)2...+ .1(.35-.15)2]

Var= .01199

S.D.= [ .01199] 1/2 = .1095 or 10.95%

Subscribe to:

Posts (Atom)