Covariance and Correlation

-Portfolio risk depends on the correlation between the returns of the assets in the portfolio

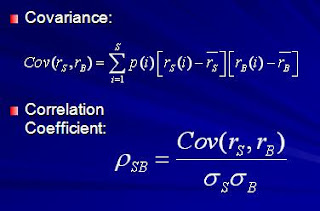

-Covariance and the correlation coefficient provide a measure of the returns on two assets to vary

Two Asset Portfolio Return – Stock and Bond

Covariance and Correlation Coefficient

Correlation Coefficients: Possible Values

Range of values for r 1,2

-1.0 < r < 1.0

If r = 1.0, the securities would be perfectly positively correlated (meaning two assets move in the same direction)

If r = - 1.0, the securities would be perfectly negatively correlated (meaning two assets move in the opposite direction)

Two Asset Portfolio St Dev – Stock and Bond

In General, For an n-Security Portfolio:

rp = Weighted average of the

n securities

sp2 = (Consider all pair-wise

covariance measures)

Three Rules of Two-Risky-Asset Portfolios

Numerical Example: Bond and Stock Returns

Returns

Bond = 6% Stock = 10%

Standard Deviation

Bond = 12% Stock = 25%

Weights

Bond = .5 Stock = .5

Correlation Coefficient

(Bonds and Stock) = 0

Return = 8%

.5(6) + .5 (10)

Standard Deviation = 13.87%

[(.5)^2 (12)^2 + (.5)^2 (25)^2 + …

2 (.5) (.5) (12) (25) (0)]^ ½

[192.25]^ ½ = 13.87

Investment Opportunity Set for Stocks and Bonds

Investment Opportunity Set for Stocks and Bonds with Various Correlations

No comments:

Post a Comment