Single Factor Model

βi = index of a securities’ particular return to the factor

M = unanticipated movement commonly related to security returns

Ei = unexpected event relevant only to this security

Assumption: a broad market index like the S&P500 is the common factor

Specification of a Single-Index Model of Security Returns

Use the S&P 500 as a market proxy

Excess return can now be stated as:

This specifies the both market and firm risk

Figure 6.11 Scatter Diagram for Dell

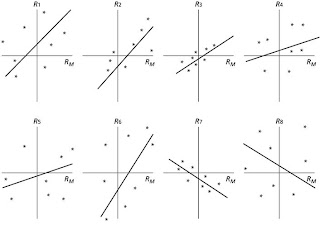

Figure 6.12 Various Scatter Diagrams

Components of Risk

Market or systematic risk: risk related to the macro economic factor or market index

Unsystematic or firm specific risk: risk not related to the macro factor or market index

Total risk = Systematic + Unsystematic

Measuring Components of Risk

si2 = bi2 sm2 + s2(ei)

where;

si2 = total variance

bi2 sm2 = systematic variance

s2(ei) = unsystematic variance

*s=std. deviation

Examining Percentage of Variance

Total Risk = Systematic Risk + Unsystematic Risk

Systematic Risk/Total Risk = p2

ßi2 s m2 / s2 = p2

bi2 sm2 / bi2 sm2 + s2(ei) = p2

Advantages of the Single Index Model

Reduces the number of inputs for diversification

Easier for security analysts to specialize

No comments:

Post a Comment