BOND CHARACTERISTICS

Face or par value

Coupon rate

Zero coupon bond

Compounding and payments

Accrued Interest

Indenture

Treasury Notes and Bonds

T Note maturities range up to 10 years

T bond maturities range from 10 – 30 years

Bid and ask price

Quoted in points and as a percent of par

Accrued interest

Quoted price does not include interest accrued

Figure 10.1 Listing of Treasury Issues

Corporate Bonds

Most bonds are traded over the counter

Registered

Bearer bonds

Call provisions

Convertible provision

Put provision (putable bonds)

Floating rate bonds

Preferred Stock

Figure 10.2 Investment Grade Bonds

Other Domestic Issuers

Federal Home Loan Bank Board

Farm Credit Agencies

Ginnie Mae

Fannie Mae

Freddie Mac

Innovations in the Bond Market

Reverse floaters

Asset-backed bonds

Pay-in-kind bonds

Catastrophe bonds

Indexed bonds

TIPS (Treasury Inflation Protected Securities)

This blog is for myself and all others who want to learn about financial investment in general. While the focus of blog is on stocks, I would also like to cover: bond, derivative (options, swaps, future and forward), fund, currency, commodity, Treasury bill (risk-free)/bond, speculation, hedge, black-scholes

Sunday, September 19, 2010

Friday, September 17, 2010

FACTOR MODELS AND THE ARBITRAGE PRICING THEORY

Arbitrage Pricing Theory

Arbitrage - arises if an investor can construct a zero beta investment portfolio with a return greater than the risk-free rate

If two portfolios are mispriced, the investor could buy the low-priced portfolio and sell the high-priced portfolio

In efficient markets, profitable arbitrage opportunities will quickly disappear

*Note: we will explore more of this with derivatives later

Figure 7.5 Security Line Characteristics

APT and CAPM Compared

APT applies to well diversified portfolios and not necessarily to individual stocks

With APT it is possible for some individual stocks to be mispriced - not lie on the SML

APT is more general in that it gets to an expected return and beta relationship without the assumption of the market portfolio

APT can be extended to multifactor models

Arbitrage - arises if an investor can construct a zero beta investment portfolio with a return greater than the risk-free rate

If two portfolios are mispriced, the investor could buy the low-priced portfolio and sell the high-priced portfolio

In efficient markets, profitable arbitrage opportunities will quickly disappear

*Note: we will explore more of this with derivatives later

Figure 7.5 Security Line Characteristics

APT and CAPM Compared

APT applies to well diversified portfolios and not necessarily to individual stocks

With APT it is possible for some individual stocks to be mispriced - not lie on the SML

APT is more general in that it gets to an expected return and beta relationship without the assumption of the market portfolio

APT can be extended to multifactor models

THE CAPM AND THE REAL WORLD

CAPM and the Real World

The CAPM was first published by Sharpe in the Journal of Finance in 1964

Many tests of the theory have since followed including Roll’s critique in 1977 and the Fama and French study in 1992

MULTIFACTOR MODELS AND THE CAPM

Multifactor Models

Limitations for CAPM

Market Portfolio is not directly observable

Research shows that other factors affect returns

Fama French Three-Factor Model

Returns are related to factors other than market returns

Size

Book value relative to market value

Three factor model better describes returns

Table 7.3 Summary Statistics for Rates of Return Series

Table 7.4 Regression Statistics for the Single-index and FF Three-factor Model

The CAPM was first published by Sharpe in the Journal of Finance in 1964

Many tests of the theory have since followed including Roll’s critique in 1977 and the Fama and French study in 1992

MULTIFACTOR MODELS AND THE CAPM

Multifactor Models

Limitations for CAPM

Market Portfolio is not directly observable

Research shows that other factors affect returns

Fama French Three-Factor Model

Returns are related to factors other than market returns

Size

Book value relative to market value

Three factor model better describes returns

Table 7.3 Summary Statistics for Rates of Return Series

Table 7.4 Regression Statistics for the Single-index and FF Three-factor Model

THE CAPM AND INDEX MODELS

Estimating the Index Model

Using historical data on T-bills, S&P 500 and individual securities

Regress risk premiums for individual stocks against the risk premiums for the S&P 500

Slope is the beta for the individual stock

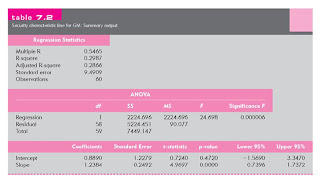

Table 7.1 Monthly Return Statistics for T-bills, S&P 500 and General Motors

Figure 7.3 Cumulative Returns for T-bills, S&P 500 and GM Stock

Figure 7.4 Characteristic Line for GM

Table 7.2 Security Characteristic Line for GM: Summary Output

GM Regression: What We Can Learn

GM is a cyclical stock

Required Return:

rf + b(rm - rf) = 2.75 + 1.24x5.5 = 9.57%

Next compute betas of other firms in the industry

Predicting Betas

The beta from the regression equation is an estimate based on past history

Betas exhibit a statistical property

Regression toward the mean

Saturday, September 11, 2010

THE CAPITAL ASSET PRICING MODEL (CAPM)

Capital Asset Pricing Model (CAPM)

What is CAPM?

It is an Equilibrium model that underlies all modern financial theory

CAMP was derived using principles of diversification with simplified assumptions

Markowitz, Sharpe, Lintner and Mossin are researchers credited with its development

Assumptions

Every financial models have key assumption to ease complexity of real worlds.

Of course there are pros and cons with those assumptions.

CAPM makes a number of assumption,

-Individual investors are price takers

-Single-period investment horizon

-Investments are limited to traded financial assets

-No taxes nor transaction costs

-Information is costless and available to all investors

-Investors are rational mean-variance optimizers

-Homogeneous expectations

Resulting Equilibrium Conditions

All investors will hold the same portfolio for risky assets – market portfolio

Market portfolio contains all securities and the proportion of each security is its market value as a percentage of total market value

Risk premium on the market depends on the average risk aversion of all market participants

Risk premium on an individual security is a function of its covariance with the market

Figure 7.1 The Efficient Frontier and the Capital Market Line

The Risk Premium of the Market Portfolio

M = Market portfolio

rf = Risk free rate

E(rM) - rf = Market risk premium

E(rM) - rf / sim = Market price of risk = Slope of the CAPM

*sim = sigma (std. deviation) of market

Expected Returns On Individual Securities

The risk premium on individual securities is a function of the individual security’s contribution to the risk of the market portfolio

Individual security’s risk premium is a function of the covariance of returns with the assets that make up the market portfolio

Expected Returns On Individual Securities: an Example

Using the Dell example from previous post:

(E(rm) - rf) / 1 = (E(rd) - rf) / Bd

Rearranging gives us the CAPM’s expected return-beta relationship

E(rd) = rf + Bd [E(rm) - rf)]

Figure 7.2 The Security Market Line and Positive Alpha Stock

SML Relationships

b = [COV(ri,rm)] / sm2

E(rm) – rf = market risk premium

SML = rf + b[E(rm) - rf]

Sample Calculations for SML

E(rm) - rf = .08 rf = .03

bx = 1.25

E(rx) = .03 + 1.25(.08) = .13 or 13%

by = .6

e(ry) = .03 + .6(.08) = .078 or 7.8%

Graph of Sample Calculations

What is CAPM?

It is an Equilibrium model that underlies all modern financial theory

CAMP was derived using principles of diversification with simplified assumptions

Markowitz, Sharpe, Lintner and Mossin are researchers credited with its development

Assumptions

Every financial models have key assumption to ease complexity of real worlds.

Of course there are pros and cons with those assumptions.

CAPM makes a number of assumption,

-Individual investors are price takers

-Single-period investment horizon

-Investments are limited to traded financial assets

-No taxes nor transaction costs

-Information is costless and available to all investors

-Investors are rational mean-variance optimizers

-Homogeneous expectations

Resulting Equilibrium Conditions

All investors will hold the same portfolio for risky assets – market portfolio

Market portfolio contains all securities and the proportion of each security is its market value as a percentage of total market value

Risk premium on the market depends on the average risk aversion of all market participants

Risk premium on an individual security is a function of its covariance with the market

Figure 7.1 The Efficient Frontier and the Capital Market Line

The Risk Premium of the Market Portfolio

M = Market portfolio

rf = Risk free rate

E(rM) - rf = Market risk premium

E(rM) - rf / sim = Market price of risk = Slope of the CAPM

*sim = sigma (std. deviation) of market

Expected Returns On Individual Securities

The risk premium on individual securities is a function of the individual security’s contribution to the risk of the market portfolio

Individual security’s risk premium is a function of the covariance of returns with the assets that make up the market portfolio

Expected Returns On Individual Securities: an Example

Using the Dell example from previous post:

(E(rm) - rf) / 1 = (E(rd) - rf) / Bd

Rearranging gives us the CAPM’s expected return-beta relationship

E(rd) = rf + Bd [E(rm) - rf)]

Figure 7.2 The Security Market Line and Positive Alpha Stock

SML Relationships

b = [COV(ri,rm)] / sm2

E(rm) – rf = market risk premium

SML = rf + b[E(rm) - rf]

Sample Calculations for SML

E(rm) - rf = .08 rf = .03

bx = 1.25

E(rx) = .03 + 1.25(.08) = .13 or 13%

by = .6

e(ry) = .03 + .6(.08) = .078 or 7.8%

Graph of Sample Calculations

Thursday, September 9, 2010

RISK OF LONG-TERM INVESTMENTS

Are Stock Returns Less Risky in the Long Run?

Consider a 2-year investment

Variance of the 2-year return is double of that of the one-year return and σ is higher by a multiple of the square root of 2

Generalizing to an investment horizon of n years and then annualizing:

The Fly in the ‘Time Diversification’ Ointment

Annualized standard deviation is only appropriate for short-term portfolios

Variance grows linearly with the number of years

Standard deviation grows in proportion to

To compare investments in two different time periods:

-Risk of the total (end of horizon) rate of return

-Accounts for magnitudes and probabilities

Consider a 2-year investment

Variance of the 2-year return is double of that of the one-year return and σ is higher by a multiple of the square root of 2

Generalizing to an investment horizon of n years and then annualizing:

The Fly in the ‘Time Diversification’ Ointment

Annualized standard deviation is only appropriate for short-term portfolios

Variance grows linearly with the number of years

Standard deviation grows in proportion to

To compare investments in two different time periods:

-Risk of the total (end of horizon) rate of return

-Accounts for magnitudes and probabilities

A SINGLE-FACTOR ASSET MARKET

Single Factor Model

βi = index of a securities’ particular return to the factor

M = unanticipated movement commonly related to security returns

Ei = unexpected event relevant only to this security

Assumption: a broad market index like the S&P500 is the common factor

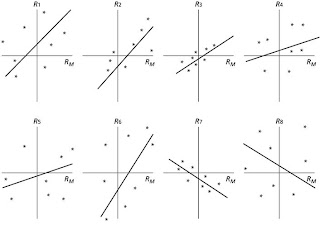

Specification of a Single-Index Model of Security Returns

Use the S&P 500 as a market proxy

Excess return can now be stated as:

This specifies the both market and firm risk

Figure 6.11 Scatter Diagram for Dell

Figure 6.12 Various Scatter Diagrams

Components of Risk

Market or systematic risk: risk related to the macro economic factor or market index

Unsystematic or firm specific risk: risk not related to the macro factor or market index

Total risk = Systematic + Unsystematic

Measuring Components of Risk

si2 = bi2 sm2 + s2(ei)

where;

si2 = total variance

bi2 sm2 = systematic variance

s2(ei) = unsystematic variance

*s=std. deviation

Examining Percentage of Variance

Total Risk = Systematic Risk + Unsystematic Risk

Systematic Risk/Total Risk = p2

ßi2 s m2 / s2 = p2

bi2 sm2 / bi2 sm2 + s2(ei) = p2

Advantages of the Single Index Model

Reduces the number of inputs for diversification

Easier for security analysts to specialize

βi = index of a securities’ particular return to the factor

M = unanticipated movement commonly related to security returns

Ei = unexpected event relevant only to this security

Assumption: a broad market index like the S&P500 is the common factor

Specification of a Single-Index Model of Security Returns

Use the S&P 500 as a market proxy

Excess return can now be stated as:

This specifies the both market and firm risk

Figure 6.11 Scatter Diagram for Dell

Figure 6.12 Various Scatter Diagrams

Components of Risk

Market or systematic risk: risk related to the macro economic factor or market index

Unsystematic or firm specific risk: risk not related to the macro factor or market index

Total risk = Systematic + Unsystematic

Measuring Components of Risk

si2 = bi2 sm2 + s2(ei)

where;

si2 = total variance

bi2 sm2 = systematic variance

s2(ei) = unsystematic variance

*s=std. deviation

Examining Percentage of Variance

Total Risk = Systematic Risk + Unsystematic Risk

Systematic Risk/Total Risk = p2

ßi2 s m2 / s2 = p2

bi2 sm2 / bi2 sm2 + s2(ei) = p2

Advantages of the Single Index Model

Reduces the number of inputs for diversification

Easier for security analysts to specialize

Monday, September 6, 2010

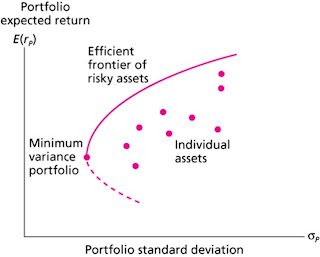

EFFICIENT DIVERSIFICATION WITH MANY RISKY ASSETS

Extending Concepts to All Securities

-The optimal combinations result in lowest level of risk for a given return

-The optimal trade-off is described as the efficient frontier

-These portfolios are dominant

Portfolios Constructed from Three Stocks A, B and C

The Efficient Frontier of Risky Assets and Individual Assets

This graph shows nothing more than an optimal choice.

Given the risk, you will pick the point along the efficient frontier which gives the maximized E(r).

-The optimal combinations result in lowest level of risk for a given return

-The optimal trade-off is described as the efficient frontier

-These portfolios are dominant

Portfolios Constructed from Three Stocks A, B and C

The Efficient Frontier of Risky Assets and Individual Assets

This graph shows nothing more than an optimal choice.

Given the risk, you will pick the point along the efficient frontier which gives the maximized E(r).

THE OPTIMAL RISKY PORTFOLIO WITH A RISK-FREE ASSET

Instead of two risky assets (bond and stock), we can compose a portfolio with one risky and one risk free assets.

Extending to Include Riskless Asset

-The optimal combination becomes linear

-A single combination of risky and riskless assets will dominate

Figure: Opportunity Set Using Stocks and Bonds and Two Capital Allocation Lines

Dominant CAL with a Risk-Free Investment (F)

CAL(O) dominates other lines -- it has the best risk/return or the largest slope

Slope = [ E(ra)-rf ] / std. dev

[ E(rp) - rf ] / std. dev. p > [ E(ra) - rf ] / std. dev.a

Regardless of risk preferences, combinations of O & F dominate

Optimal Capital Allocation Line for Bonds, Stocks and T-Bills

The Complete Portfolio

The Complete Portfolio – Solution to the Asset Allocation Problem

Instead of two risky assets (bond and stock), we can compose a portfolio with one risky and one risk free assets.

Extending to Include Riskless Asset

-The optimal combination becomes linear

-A single combination of risky and riskless assets will dominate

Figure: Opportunity Set Using Stocks and Bonds and Two Capital Allocation Lines

Dominant CAL with a Risk-Free Investment (F)

CAL(O) dominates other lines -- it has the best risk/return or the largest slope

Slope = [ E(ra)-rf ] / std. dev

[ E(rp) - rf ] / std. dev. p > [ E(ra) - rf ] / std. dev.a

Regardless of risk preferences, combinations of O & F dominate

Optimal Capital Allocation Line for Bonds, Stocks and T-Bills

The Complete Portfolio

The Complete Portfolio – Solution to the Asset Allocation Problem

Saturday, September 4, 2010

ASSET ALLOCATION WITH TWO RISKY ASSETS

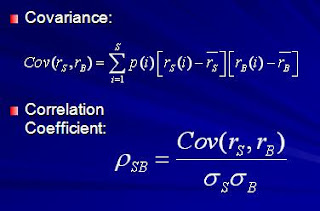

Covariance and Correlation

-Portfolio risk depends on the correlation between the returns of the assets in the portfolio

-Covariance and the correlation coefficient provide a measure of the returns on two assets to vary

Two Asset Portfolio Return – Stock and Bond

Covariance and Correlation Coefficient

Correlation Coefficients: Possible Values

Range of values for r 1,2

-1.0 < r < 1.0

If r = 1.0, the securities would be perfectly positively correlated (meaning two assets move in the same direction)

If r = - 1.0, the securities would be perfectly negatively correlated (meaning two assets move in the opposite direction)

Two Asset Portfolio St Dev – Stock and Bond

In General, For an n-Security Portfolio:

rp = Weighted average of the

n securities

sp2 = (Consider all pair-wise

covariance measures)

Three Rules of Two-Risky-Asset Portfolios

Numerical Example: Bond and Stock Returns

Returns

Bond = 6% Stock = 10%

Standard Deviation

Bond = 12% Stock = 25%

Weights

Bond = .5 Stock = .5

Correlation Coefficient

(Bonds and Stock) = 0

Return = 8%

.5(6) + .5 (10)

Standard Deviation = 13.87%

[(.5)^2 (12)^2 + (.5)^2 (25)^2 + …

2 (.5) (.5) (12) (25) (0)]^ ½

[192.25]^ ½ = 13.87

Investment Opportunity Set for Stocks and Bonds

Investment Opportunity Set for Stocks and Bonds with Various Correlations

-Portfolio risk depends on the correlation between the returns of the assets in the portfolio

-Covariance and the correlation coefficient provide a measure of the returns on two assets to vary

Two Asset Portfolio Return – Stock and Bond

Covariance and Correlation Coefficient

Correlation Coefficients: Possible Values

Range of values for r 1,2

-1.0 < r < 1.0

If r = 1.0, the securities would be perfectly positively correlated (meaning two assets move in the same direction)

If r = - 1.0, the securities would be perfectly negatively correlated (meaning two assets move in the opposite direction)

Two Asset Portfolio St Dev – Stock and Bond

In General, For an n-Security Portfolio:

rp = Weighted average of the

n securities

sp2 = (Consider all pair-wise

covariance measures)

Three Rules of Two-Risky-Asset Portfolios

Numerical Example: Bond and Stock Returns

Returns

Bond = 6% Stock = 10%

Standard Deviation

Bond = 12% Stock = 25%

Weights

Bond = .5 Stock = .5

Correlation Coefficient

(Bonds and Stock) = 0

Return = 8%

.5(6) + .5 (10)

Standard Deviation = 13.87%

[(.5)^2 (12)^2 + (.5)^2 (25)^2 + …

2 (.5) (.5) (12) (25) (0)]^ ½

[192.25]^ ½ = 13.87

Investment Opportunity Set for Stocks and Bonds

Investment Opportunity Set for Stocks and Bonds with Various Correlations

DIVERSIFICATION AND PORTFOLIO RISK

Diversification means reducing risk by investing in a variety of assets. In other words, you are spreading risks among assets. There are two different types of risk in investment.

1. Market risk

-Systematic or Nondiversifiable

2. Firm-specific risk

-Diversifiable or nonsystematic

Market risk is systematic and everyone involved in market must bear it. On the other hand, firm specific can be diversified to some degree.

Here's a figure showing Portfolio Risk as a Function of the Number of Stocks.

As you can see on the B, market risk is fixed at some level and firm-specific adds up.

Portfolio Risk as a Function of Number of Securities

A graph above illustrates that risk (std deviation) declines as the number of stocks in a portfolio increases.

1. Market risk

-Systematic or Nondiversifiable

2. Firm-specific risk

-Diversifiable or nonsystematic

Market risk is systematic and everyone involved in market must bear it. On the other hand, firm specific can be diversified to some degree.

Here's a figure showing Portfolio Risk as a Function of the Number of Stocks.

As you can see on the B, market risk is fixed at some level and firm-specific adds up.

Portfolio Risk as a Function of Number of Securities

A graph above illustrates that risk (std deviation) declines as the number of stocks in a portfolio increases.

Thursday, September 2, 2010

PASSIVE STRATEGIES AND THE CAPITAL MARKET LINE

Average Rates of Return, Standard Deviation and Reward to Variability

Costs and Benefits of Passive Investing

1. Active strategy entails costs: If you pick active strategy, you need constant flow of updated information. This can be very costly. In addition to that, you keep the track of your stocks every hour, minute or even second. Monitoring every movement is time consuming and may need a bunch of staff members to do so. On top of that, you must adapt to changing environment whether it is an external or internal and reevaluate your stocks accordingly.

2. Free-rider benefit

3. Involves investment in two passive portfolios

-Short-term T-bills

-Fund of common stocks that mimics a broad market index

Costs and Benefits of Passive Investing

1. Active strategy entails costs: If you pick active strategy, you need constant flow of updated information. This can be very costly. In addition to that, you keep the track of your stocks every hour, minute or even second. Monitoring every movement is time consuming and may need a bunch of staff members to do so. On top of that, you must adapt to changing environment whether it is an external or internal and reevaluate your stocks accordingly.

2. Free-rider benefit

3. Involves investment in two passive portfolios

-Short-term T-bills

-Fund of common stocks that mimics a broad market index

ASSET ALLOCATION ACROSS RISKY AND RISK-FREE PORTFOLIOS

Allocating Capital

1. Possible to split investment funds between safe and risky assets

2. Risk free asset: proxy; T-bills

3. Risky asset: stock (or a portfolio)

Issues to consider

1. Examine risk/ return tradeoff

2. Demonstrate how different degrees of risk aversion will affect allocations between risky and risk free assets

Example

Total portfolio value = $300,000

Risk-free value = 90,000

Risky (Vanguard and Fidelity) = 210,000

Vanguard (V) = 54%

Fidelity (F) = 46%

CALCULATING EXPECTED RETURN

rf = 7%

srf = 0% (std. dev of risk free)

E(rp) = 15%

sp = 22% (std. dev of portfolio)

y = % in p (risky)

(1-y) = % in rf

E(rc) = yE(rp) + (1 - y)rf

rc = complete or combined portfolio

For example, y = .75

E(rc) = .75(.15) + .25(.07)

= .13 or 13%

Investment Opportunity Set with a Risk-Free Investment

Variance on the Possible Combined Portfolios: Since srf = 0 then sc = y*sp

What it means is that standard deviation of risk free asset = 0. So only variance/std deviation that we should be concerned is risky asset/portfolio. Multiply std deviation of risky asset by the asset's allocation % to get total std. deviation.

Combinations Without Leverage

If y = .75, then

sc = .75(.22) = .165 or 16.5%

If y = 1

sc = 1(.22) = .22 or 22%

If y = 0

sc = 0(.22) = .00 or 0%

Using Leverage with Capital Allocation Line

Borrow at the Risk-Free Rate and invest in stock

Using 50% Leverage

rc = (-.5) (.07) + (1.5) (.15) = .19

sc = (1.5) (.22) = .33

Risk Aversion and Allocation

1. Greater levels of risk aversion lead to larger proportions of the risk free rate

2. Lower levels of risk aversion lead to larger proportions of the portfolio of risky assets

3. Willingness to accept high levels of risk for high levels of returns would result in leveraged combinations

1. Possible to split investment funds between safe and risky assets

2. Risk free asset: proxy; T-bills

3. Risky asset: stock (or a portfolio)

Issues to consider

1. Examine risk/ return tradeoff

2. Demonstrate how different degrees of risk aversion will affect allocations between risky and risk free assets

Example

Total portfolio value = $300,000

Risk-free value = 90,000

Risky (Vanguard and Fidelity) = 210,000

Vanguard (V) = 54%

Fidelity (F) = 46%

CALCULATING EXPECTED RETURN

rf = 7%

srf = 0% (std. dev of risk free)

E(rp) = 15%

sp = 22% (std. dev of portfolio)

y = % in p (risky)

(1-y) = % in rf

E(rc) = yE(rp) + (1 - y)rf

rc = complete or combined portfolio

For example, y = .75

E(rc) = .75(.15) + .25(.07)

= .13 or 13%

Investment Opportunity Set with a Risk-Free Investment

Variance on the Possible Combined Portfolios: Since srf = 0 then sc = y*sp

What it means is that standard deviation of risk free asset = 0. So only variance/std deviation that we should be concerned is risky asset/portfolio. Multiply std deviation of risky asset by the asset's allocation % to get total std. deviation.

Combinations Without Leverage

If y = .75, then

sc = .75(.22) = .165 or 16.5%

If y = 1

sc = 1(.22) = .22 or 22%

If y = 0

sc = 0(.22) = .00 or 0%

Using Leverage with Capital Allocation Line

Borrow at the Risk-Free Rate and invest in stock

Using 50% Leverage

rc = (-.5) (.07) + (1.5) (.15) = .19

sc = (1.5) (.22) = .33

Risk Aversion and Allocation

1. Greater levels of risk aversion lead to larger proportions of the risk free rate

2. Lower levels of risk aversion lead to larger proportions of the portfolio of risky assets

3. Willingness to accept high levels of risk for high levels of returns would result in leveraged combinations

INFLATION AND REAL RATES OF RETURN

Real vs. Nominal Rates

It is an important element to consider in an investment. Unfortunately many people ignore real value of their returns and exclusively focus on nominal value. For instance, your t-bill yielded 3.5% last year but inflation rate for the year was 4%. A dollar invested in the t-bill became $1.035. That sure is increase in nominal value but are you truly better off? Well, no. Because after the inflation, you actually incurred a loss of 0.5%. Compared to last year, you have less purchasing power.

As a shrewd investor, you must take inflation into account and compute real rate of return.

Fisher effect: Approximation

nominal rate = real rate + inflation premium

Note that this is only an approximation and not an accurate formula but it is close enough. So no further complex computation is not needed.

R = r + i or r = R - i

R = nominal and r = real

Example r = 3%, i = 6%

R = 9% = 3% + 6% or 3% = 9% - 6%

It is an important element to consider in an investment. Unfortunately many people ignore real value of their returns and exclusively focus on nominal value. For instance, your t-bill yielded 3.5% last year but inflation rate for the year was 4%. A dollar invested in the t-bill became $1.035. That sure is increase in nominal value but are you truly better off? Well, no. Because after the inflation, you actually incurred a loss of 0.5%. Compared to last year, you have less purchasing power.

As a shrewd investor, you must take inflation into account and compute real rate of return.

Fisher effect: Approximation

nominal rate = real rate + inflation premium

Note that this is only an approximation and not an accurate formula but it is close enough. So no further complex computation is not needed.

R = r + i or r = R - i

R = nominal and r = real

Example r = 3%, i = 6%

R = 9% = 3% + 6% or 3% = 9% - 6%

Wednesday, September 1, 2010

Risk Premiums and Risk Aversion

Risk level of an investor is determined by degree to which investors are willing to commit funds

Risk aversion is how reluctant you are in investing.

If T-Bill denotes the risk-free rate, rf, and variance denotes volatility of returns then:

The risk premium of a portfolio is: E(rp) - rf

In other words, expected return of portfolio minus risk-free rate.

To quantify the degree of risk aversion with parameter A:

The Sharpe (Reward-to-Volatility) Measure

This sharpe ratio is known to be used by mutual/hedge fund managers. This shows how much extra/additional return (excessive return or premium) you are earning when you bear a unit of risk in an investment. The Sharpe ratio has as its principal advantage that it is directly computable from any observed series of returns without need for additional information surrounding the source of profitability.

Risk aversion is how reluctant you are in investing.

If T-Bill denotes the risk-free rate, rf, and variance denotes volatility of returns then:

The risk premium of a portfolio is: E(rp) - rf

In other words, expected return of portfolio minus risk-free rate.

To quantify the degree of risk aversion with parameter A:

The Sharpe (Reward-to-Volatility) Measure

This sharpe ratio is known to be used by mutual/hedge fund managers. This shows how much extra/additional return (excessive return or premium) you are earning when you bear a unit of risk in an investment. The Sharpe ratio has as its principal advantage that it is directly computable from any observed series of returns without need for additional information surrounding the source of profitability.

Risk and risk premium

Risk is uncertainty. When you make an investment, there is always a risk associated with it whether it is a bond, stock, fund, etc. Risk arises from uncertainty. We don't know market direction next year. As a matter of fact, we don't even know how market will drop/raise our stock price tomorrow. Risk can be separated into 2 different types. One is an internal risk. This is also known as a business specific risk, where uncertainty comes from the company and its operation. The other one is a market risk. This is an external risk that you will have to bear.

Scenario Analysis and Probability Distributions

In order to examine risk, we can look at the risk/uncertainty using probability. Here 3 important variables that you need to know before moving on the analysis.

1) Mean: most likely value

2) Variance or standard deviation

3) Skewness

This picture demonstrates famous concept known as "normal distribution." The normal distribution is an absolutely continuous probability distribution whose cumulants of all orders above two are zero. Note that norm. distribution has mean equals to median.

In probability theory and statistics, skewness is a measure of the asymmetry of the probability distribution of a real-valued random variable. skewness value can be positive or negative, or even undefined. Qualitatively, a negative skew indicates that the tail on the left side of probability density function is longer than the right side and the bulk of the values (including the median) lie to the right of the mean. A positive skew indicates that the tail on the right side is longer than the left side and the bulk of the values lie to the left of the mean.

Measuring Mean: Scenario or Subjective Returns

p(s) = probability of a state

r(s) = return if a state occurs

1 to s states

This is a formula to calculate expected return (subjective/scenario return), which is equals to multiplication of each state's probability (in decimal) and return. After you get each value, sum them up to get final E(r) value.

Numerical Example: Subjective or Scenario Distributions

State Prob. of State rin State

1 .1 -.05

2 .2 .05

3 .4 .15

4 .2 .25

5 .1 .35

E(r) = (.1)(-.05) + (.2)(.05)...+ (.1)(.35)

E(r) = .15 or 15%

Measuring Variance or Dispersion of Returns

Variance is used as one of several descriptors of a distribution. It describes how far values lie from the mean.

Var = sum of probability (in decimal) multiplied by outcome of individual return minus average. And Standard deviation is simply a square root of variance.

Using the same example above,

Var =[(.1)(-.05-.15)2+(.2)(.05- .15)2...+ .1(.35-.15)2]

Var= .01199

S.D.= [ .01199] 1/2 = .1095 or 10.95%

Scenario Analysis and Probability Distributions

In order to examine risk, we can look at the risk/uncertainty using probability. Here 3 important variables that you need to know before moving on the analysis.

1) Mean: most likely value

2) Variance or standard deviation

3) Skewness

This picture demonstrates famous concept known as "normal distribution." The normal distribution is an absolutely continuous probability distribution whose cumulants of all orders above two are zero. Note that norm. distribution has mean equals to median.

In probability theory and statistics, skewness is a measure of the asymmetry of the probability distribution of a real-valued random variable. skewness value can be positive or negative, or even undefined. Qualitatively, a negative skew indicates that the tail on the left side of probability density function is longer than the right side and the bulk of the values (including the median) lie to the right of the mean. A positive skew indicates that the tail on the right side is longer than the left side and the bulk of the values lie to the left of the mean.

Measuring Mean: Scenario or Subjective Returns

p(s) = probability of a state

r(s) = return if a state occurs

1 to s states

This is a formula to calculate expected return (subjective/scenario return), which is equals to multiplication of each state's probability (in decimal) and return. After you get each value, sum them up to get final E(r) value.

Numerical Example: Subjective or Scenario Distributions

State Prob. of State rin State

1 .1 -.05

2 .2 .05

3 .4 .15

4 .2 .25

5 .1 .35

E(r) = (.1)(-.05) + (.2)(.05)...+ (.1)(.35)

E(r) = .15 or 15%

Measuring Variance or Dispersion of Returns

Variance is used as one of several descriptors of a distribution. It describes how far values lie from the mean.

Var = sum of probability (in decimal) multiplied by outcome of individual return minus average. And Standard deviation is simply a square root of variance.

Using the same example above,

Var =[(.1)(-.05-.15)2+(.2)(.05- .15)2...+ .1(.35-.15)2]

Var= .01199

S.D.= [ .01199] 1/2 = .1095 or 10.95%

Tuesday, August 31, 2010

Quoting Conventions

APR = annual percentage rate

(periods in year) X (rate for period)

EAR = effective annual rate

( 1+ rate for period)^Periods per yr - 1

Example: monthly return of 1%

APR = 1% X 12 = 12%

EAR = (1.01)^12 - 1 = 12.68%

(periods in year) X (rate for period)

EAR = effective annual rate

( 1+ rate for period)^Periods per yr - 1

Example: monthly return of 1%

APR = 1% X 12 = 12%

EAR = (1.01)^12 - 1 = 12.68%

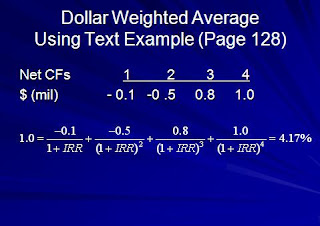

Dollar weighted returns

Here are some characteristics of dollar weighted returns.

-It considers changes in investment

-Initial Investment is an outflow (money going out from your pocket)

-Ending value is considered as an inflow (money coming into your pocket)

-Additional investment is a negative flow (Again, money leaving your pocket)

-Reduced investment is a positive flow (Again, money coming back to your pocket)

Dollar weighted return is nothing more than a IRR.

Internal Rate of Return (IRR) is the discount rate that results in present value of the future cash flows being equal to the investment amount.

Example

When you compute the IRR, this is the rate of return at which the net present value of project/investment is zero. In other words, if the internal rate of return exceeds the cost of financing the project, then the investment is profitable.

We can also approach it from NPV perspective.

NPV = Sum of CFt/ (1+ Rt)^t from period t=0 to n.

Whereas NPV = Net present value and CFt = Cash flow at time t.

When the rate of return is smaller than the IRR rate Rt then the investment is profitable (meaning NPV > 0 ). Otherwise, investment is not profitable.

IRR can also be a good measurement when considering multiple investment with a limited budget.

So if you have two different stocks in mind but only have a few hundred bucks then you would compute IRR and see which one has higher IRR.

However, there are some limitations with dollar weighted returns.

If cash flow changes from positive to negative or from negative to positive, IRR for investment cannot be calculated. Additionally, when you use IRR to evaluate multiple investment, result might indicate different ranking than NPV.

For instance NPVa = 50 and NPVb = 100 but IRRa = 5 % and IRRb = 3.6 %

In this case, NPV indicate that investment b is more profitable but IRR says a is better.

Which one should you choose?

If NPV and IRR give different result then NPV always rules over IRR. So investment b is superior.

This is because of IRR's weaknesses. First IRR uses single discount rate failing to accommodate changes in the rate. Second, IRR sometimes cannot be computed with mixture of positive and negative cash flow. And lastly, discount rate is sometimes unknown. You compare IRR to discount rate and then proceed to make an investment if IRR> discount rate. But if discount rate is unknown or cannot be applied for whatever reason then IRR does not work. On the other hand, NPV is inherently complex and requires assumption at each stage. If NPV > 0 then we know investment is worthwhile. This is why NPV is superior than IRR.

-It considers changes in investment

-Initial Investment is an outflow (money going out from your pocket)

-Ending value is considered as an inflow (money coming into your pocket)

-Additional investment is a negative flow (Again, money leaving your pocket)

-Reduced investment is a positive flow (Again, money coming back to your pocket)

Dollar weighted return is nothing more than a IRR.

Internal Rate of Return (IRR) is the discount rate that results in present value of the future cash flows being equal to the investment amount.

Example

When you compute the IRR, this is the rate of return at which the net present value of project/investment is zero. In other words, if the internal rate of return exceeds the cost of financing the project, then the investment is profitable.

We can also approach it from NPV perspective.

NPV = Sum of CFt/ (1+ Rt)^t from period t=0 to n.

Whereas NPV = Net present value and CFt = Cash flow at time t.

When the rate of return is smaller than the IRR rate Rt then the investment is profitable (meaning NPV > 0 ). Otherwise, investment is not profitable.

IRR can also be a good measurement when considering multiple investment with a limited budget.

So if you have two different stocks in mind but only have a few hundred bucks then you would compute IRR and see which one has higher IRR.

However, there are some limitations with dollar weighted returns.

If cash flow changes from positive to negative or from negative to positive, IRR for investment cannot be calculated. Additionally, when you use IRR to evaluate multiple investment, result might indicate different ranking than NPV.

For instance NPVa = 50 and NPVb = 100 but IRRa = 5 % and IRRb = 3.6 %

In this case, NPV indicate that investment b is more profitable but IRR says a is better.

Which one should you choose?

If NPV and IRR give different result then NPV always rules over IRR. So investment b is superior.

This is because of IRR's weaknesses. First IRR uses single discount rate failing to accommodate changes in the rate. Second, IRR sometimes cannot be computed with mixture of positive and negative cash flow. And lastly, discount rate is sometimes unknown. You compare IRR to discount rate and then proceed to make an investment if IRR> discount rate. But if discount rate is unknown or cannot be applied for whatever reason then IRR does not work. On the other hand, NPV is inherently complex and requires assumption at each stage. If NPV > 0 then we know investment is worthwhile. This is why NPV is superior than IRR.

Returns using arithmetic and geometric average

Arithmetic

rA = (r1 + r2 + r3 + ...rN) / N

rA = Arithmetic return

r1 = return 1, r2 = return 2, rN = return N, N = total number of returns

Example

rA = ( .10 + .25 - .20 + .25) / 4 = .10 or 10 %

Geometric

rg = {[(1+r1) (1+r2) .... (1+rn)]}^ 1/n - 1

Example

rg = {[(1.1) (1.25) (.8) (1.25)]}^ 1/4 - 1

= (1.5150) 1/4 -1 = .0829 = 8.29%

Note that arithmetic average works better when each number is independent whereas geometric is a better choice if numbers are dependent to each other.

For instance, lets say you are trying to calculate average for annual stock returns over fiver year period. Each year's stock return is not independent of past year's performance. If you incur loss in one year then you have less capital to generate return following year. For this reason, geometric average may give more accurate performance of your portfolio.

rA = (r1 + r2 + r3 + ...rN) / N

rA = Arithmetic return

r1 = return 1, r2 = return 2, rN = return N, N = total number of returns

Example

rA = ( .10 + .25 - .20 + .25) / 4 = .10 or 10 %

Geometric

rg = {[(1+r1) (1+r2) .... (1+rn)]}^ 1/n - 1

Example

rg = {[(1.1) (1.25) (.8) (1.25)]}^ 1/4 - 1

= (1.5150) 1/4 -1 = .0829 = 8.29%

Note that arithmetic average works better when each number is independent whereas geometric is a better choice if numbers are dependent to each other.

For instance, lets say you are trying to calculate average for annual stock returns over fiver year period. Each year's stock return is not independent of past year's performance. If you incur loss in one year then you have less capital to generate return following year. For this reason, geometric average may give more accurate performance of your portfolio.

Sunday, August 29, 2010

Risk and returns

We all know that risk and return have a direct relationship. If you want a bigger return then you must be willing to take additional risks that come along with it.

Let us see how to compute rate of return.

Holding period return for stock

HPR = (P1-P0+D1) / P0

Whereas P0=beginning price, P1= ending price, D1 = dividend

This return shows what % you earned during the stock holding period.

Example

Ending price = 24

Beginning price = 20

Dividend = 1

HPR = (24-20+1) / 20 = 25%

This is for a single period. In contrast when you want to measure return over multiple periods, you may need to measure how your investment performed over a preceding five-year period. Note that return measure is more ambiguous in this case.

Here's the example of multiple period return.

Let us see how to compute rate of return.

Holding period return for stock

HPR = (P1-P0+D1) / P0

Whereas P0=beginning price, P1= ending price, D1 = dividend

This return shows what % you earned during the stock holding period.

Example

Ending price = 24

Beginning price = 20

Dividend = 1

HPR = (24-20+1) / 20 = 25%

This is for a single period. In contrast when you want to measure return over multiple periods, you may need to measure how your investment performed over a preceding five-year period. Note that return measure is more ambiguous in this case.

Here's the example of multiple period return.

Tuesday, August 24, 2010

Leverage

In finance, leverage is any technique that is used to multiply gain or loss. Common usage of leverage is borrowing money to finance investment. For instance, let us say you bought 100 shares of stock A trading at $10. Total investment value is $1000. If the stock price increases from $10 to $15 then you have total investment value of $1500. So HPR would be (1500-1000)/1000 = .5 or 50 %. Now if you leverage your investment by borrowing money from your broker, return would be different. Let us say you borrow $1000 from Schwab and buy additional 100 shares at the same price $10 then you have total investment worth $2000. Again the stock price rises from $10 to $15. Here your total investment value becomes $3000. Subtract the borrowed fund $1000, which you will have to repay. Then you have final value of $2000. Your HPR would be (2000-1000)/1000 = 1 or 100 %. By borrowing half of your investment fund, you just doubled your return.

Case 1

100 shares at $10 = $1000 total

If stock price increases from $10 to $15

HPR = ($1500 - 1000)/ 1000 = .5 or 50 %

Case 2

100 shares at $10 = $1000

Additional 100 shares at $10 = $1000 ->borrowed fund from Schwab

Total investment value = $2000

If stock price increases from $10 to $15

HPR = ($3000 - 1000 - 1000) / 1000 = 1 or 100%

It is very important to acknowledge that leverage also works the same way in negative return. So that means if a half of your investment is leveraged then your profit or loss will be doubled. If stock price in the above declined from $10 to 5 then would have -50% return in the first case and -100% return in the second case.

Note that margin rate (interest you need to pay for borrowing fund) is not included in the calculation.

Leverage can be an excellent way to boost your return while it imposes a significant amount of risk. Shrewd investors must be careful using leverage and be willing to accept the risk that comes along.

Case 1

100 shares at $10 = $1000 total

If stock price increases from $10 to $15

HPR = ($1500 - 1000)/ 1000 = .5 or 50 %

Case 2

100 shares at $10 = $1000

Additional 100 shares at $10 = $1000 ->borrowed fund from Schwab

Total investment value = $2000

If stock price increases from $10 to $15

HPR = ($3000 - 1000 - 1000) / 1000 = 1 or 100%

It is very important to acknowledge that leverage also works the same way in negative return. So that means if a half of your investment is leveraged then your profit or loss will be doubled. If stock price in the above declined from $10 to 5 then would have -50% return in the first case and -100% return in the second case.

Note that margin rate (interest you need to pay for borrowing fund) is not included in the calculation.

Leverage can be an excellent way to boost your return while it imposes a significant amount of risk. Shrewd investors must be careful using leverage and be willing to accept the risk that comes along.

Monday, August 23, 2010

Gary Pilgrim

Gary Pilgrim is the manager of PBHG Growth, one of the top performing mutual funds. In similarity with O'Neil, he is a dynamic growth investor who puts lots of emphasis on earning momentum.

In order to avoid emotion affecting his buy/sell decision, he automates the process via using computer ranking system. First, system looks for the stocks that have increased their earnings by 20 % or more for two consecutive quarters. And then the system analyze if a stock has an upward earning estimate and positive earning surprise. Pilgrim is a number cruncher and barely visit his holding companies or have a meeting with the management team. His objective is to know how the companies are doing as opposed to what they are doing.

Pilgrim looks for high earning expectations and positive earning surprises. In other words, he likes company that analyst expect its earning to increase and have performed ever better than the expectation in past. Also, earning itself is not as meaning unless it has been growing over a period of time. Pilgrim looks at the rate of acceleration to figure out how rapidly company's earning has been growing. He wants to see a company's quarter earning greater than the earning from same quarter from a previous year.

In addition, Pilgrim pays a close attention to company balance sheet. In order to evaluate how company is managing its money, Pilgrim uses the BS as a reference and see if a company has what % of profit margin and $ value of debts.

Surprisingly, valuation models have no roles in Pilgrim's investment. Pilgrim mentions that P/E of 40 does not mean anything unless you look at the underlying growth characteristic of the stock. For instance, if a company has P/E of 20 but its earning growth rate is 25% then the stock is trading at a discount. He focuses entirely on growth factors when buying/selling stocks. Here, Pilgrim's view point of stock value equals to the expected value of net income. So it would something like S = E(NI). In contrary with O'Neil who stops loss at 8%, Pilgrim actually buys more of its stocks if its price decline but earning factors remain same. Ironically, that side of Pilgrim is somewhat similar to value investors because he withstand market volatility if he believes that stock is fundamentally undervalued.

Pilgrim once mentioned that growth investing may not be a good option for individual investors. That is, market fluctuate every second and so does the expected earning growth rates of companies. Professional analysts have thousands of $ worth access to information and they can keep the track of price movement and earning related news instantaneously. Whereas, individual investors have limited sources and it is a very time+effort consuming job. Pilgrim believes that investment success or failure submits to your own personal conviction and work habits. Because one method works for Pilgrim, it does not mean that very method will work for you. On the other had, there are a plenty of value investors who made successful investments while Pilgrim insists on growth investing. Hence, you must develop an investment strategies that best fit your objective and styles, which will reflect your believe and value system.

In order to avoid emotion affecting his buy/sell decision, he automates the process via using computer ranking system. First, system looks for the stocks that have increased their earnings by 20 % or more for two consecutive quarters. And then the system analyze if a stock has an upward earning estimate and positive earning surprise. Pilgrim is a number cruncher and barely visit his holding companies or have a meeting with the management team. His objective is to know how the companies are doing as opposed to what they are doing.

Pilgrim looks for high earning expectations and positive earning surprises. In other words, he likes company that analyst expect its earning to increase and have performed ever better than the expectation in past. Also, earning itself is not as meaning unless it has been growing over a period of time. Pilgrim looks at the rate of acceleration to figure out how rapidly company's earning has been growing. He wants to see a company's quarter earning greater than the earning from same quarter from a previous year.

In addition, Pilgrim pays a close attention to company balance sheet. In order to evaluate how company is managing its money, Pilgrim uses the BS as a reference and see if a company has what % of profit margin and $ value of debts.

Surprisingly, valuation models have no roles in Pilgrim's investment. Pilgrim mentions that P/E of 40 does not mean anything unless you look at the underlying growth characteristic of the stock. For instance, if a company has P/E of 20 but its earning growth rate is 25% then the stock is trading at a discount. He focuses entirely on growth factors when buying/selling stocks. Here, Pilgrim's view point of stock value equals to the expected value of net income. So it would something like S = E(NI). In contrary with O'Neil who stops loss at 8%, Pilgrim actually buys more of its stocks if its price decline but earning factors remain same. Ironically, that side of Pilgrim is somewhat similar to value investors because he withstand market volatility if he believes that stock is fundamentally undervalued.

Pilgrim once mentioned that growth investing may not be a good option for individual investors. That is, market fluctuate every second and so does the expected earning growth rates of companies. Professional analysts have thousands of $ worth access to information and they can keep the track of price movement and earning related news instantaneously. Whereas, individual investors have limited sources and it is a very time+effort consuming job. Pilgrim believes that investment success or failure submits to your own personal conviction and work habits. Because one method works for Pilgrim, it does not mean that very method will work for you. On the other had, there are a plenty of value investors who made successful investments while Pilgrim insists on growth investing. Hence, you must develop an investment strategies that best fit your objective and styles, which will reflect your believe and value system.

Sunday, August 22, 2010

How to make money in stocks

Willieam O'Neil is the founder of Invester Business Daily, which is a major competitor of the Wall STreet Journal. He also wrote a book called "How to make money in stocks," which represents his knowledge about growth investing. O'Neil has a sounding system/standard that he uses to screen out the stocks that meets his requirement. This system is known as CAN SLIM. It is an acronym for the attributes of companies/stocks that he considers to be investable. O'Neil emphasizes that a company must have all seven attributes in order to be considered for investment.

C: Current quarterly earnings per share must be accelerating. When comparied to the same quarter from previous year, O'Neil wants to see increase in the current quarterly EPS. Bigger is always better. However, you must be careful not to be misled by a huge jump. For instance, a company's quarter EPS might have increased from $.01 to $.10, which is 900% increase but it is no better than increase from $.50 to $1 because the former is most likley to be distored and thus as not meaningful as the latter.

A: Annual EPS must be accerlating. Similar to "C", O'Neil wants to see each year's EPS increasing for the past five years. Preferably, the growth rate should be at least 25%.

N: New highs/something. O'Neil likes companies that have new products, services, management, or something that is postively contributing to the company. But more importantly, he likes stocks that are pushing to new highs. In here, we are talking about 52 weeks new high. Past 52 weeks, stock could've hit the low of $5 and high of $25. At the time when O'Neil buys the stock, the stock should be pushing to new high of $26.

S: Demand of stock should be greather than its supply. Supply and demand affect the price of everything including stocks. All other things being equal, stock with 50M shares oustanding is a better pick than a stock with 100M shares oustanding. You can compare to trading volume of stock and the number of shares outstanding to figure out the stock's supply and demand.

L: Leaders in an industry, AKA best relative price strength. Investor's Business Daily shows the relative price strength of stock, ranging from 1 to 99. Here if number is bigger, stock's performance is stronger so that means higher relarive price strength stock outperformed lower numbered stocks.

I: Institutional ownership must be moderate. As mentioned, demand is needed to drive stock price up. Institutional buying is one of the best source to measure stock's demand. Mutual funds, pention plan, banks and insurance companies are all institutional investors. O'Neil wants his stock to be owned by moderated number of institutions. If it's too small, that means demand is weak. That is not much of a problem. Perhaps, stock is undiscoverd yet and it has an opportunity to attract instituion and price will rocket soar. But on the other hand if stock is heavily owned by institutions then it may be over demanded. Moreover, if all the instituions reacts in the same way to negative news, they can dump a large number of shares and its price will plummet.

M: Market direction should be upward/positive. Even if you the greatest stock of all time, its price will probably decline if the market as a whore is doing poorly. Your stock might get back to its intrinsic value once market starts to recover but O'Neil is strictly a growth investor. In order to see the direction of market, O'Neil recommends watching the market average everyday. You can do so by following the daily price and volume of DJIA, SP500, NASDAQ and what not.

O'Neil believe in growth investing and completely ignores valuation models. He mentioned that cheap stocks are cheap for reasons and you get what you pay for. He basically does not care about P/E ratio. To him, relation between earning and price are irrelevant and should focus on earning acceleration itself. In addition, he believe in law of motion. This does not have anything to do with physics. N of CAN SLIM represents new highs of stock. He said, "What seems too high and risky usually goes higher and what seems low and cheaper usually goes lower." His firm's research back up his idea. According to it, stocks on the new high list tend to go higher while stocks on the new low list tend to go lower. Besides the stock price, O'Neil aggrees with Lynch that insider ownership and little debts are postive sign of stock.

Average down Vs. Retail Investment

O'Neil argues that investors should manage their portfolio as if they were managing retail store. On the shelf you have item A and B, if A sells better than B then what should you do? Obviously, put more As and get rid of Bs. This is retail investment: you buy more of what is working and sell off worse performers. In contrary, some investors do exactly opposite. They sell the better performers and add money to stocks that have fallen in price. This is not necessarily wrong. If you are very sure that your stock is undervalued and its price will drive back to the intrinsic value, you are buying the additional shares at a discount. But if your analysis is off by few dollars or so, you could be wasting substantial amount of money buying losers while your better performers are rocket soaring.

Automation of buying and selling

O'Neil likes to automate his transaction. By doing so, you are protected from emotional decisions. O'Neil places stop losses on his stocks, usually at 8%. Note that the stop losses should be applied to the new money invested in. For instance, if you initially bought 100 shares of stock at $10 then your total investment is $1000. It has risen 50% and then falls back to 40%. This necessarily may not be time to stop losses. Let us say that you add more money into it while the price is rising, O'Neil recommends stopping losses on that money if the stock slides back while keeping your inial investment money in the stock. So your stop threshold for the initial investment would be $9.2 while new stop loss for additional investment would be $13.8. O'Neil is an advocate of averaing up, also known as pyramiding. The plan is to move more moreny into your winners. O'Neil said, "Your objective in the market is not to be right but to make big money when you were right." This is simple but a powerful statement. When one of your stock picks declines and you sell it off because it hit the stop loss, you may not be valuing it correctly. The stock could be truly undervalued and its price may go up in the future. But what O'Neil is aruguing is that your job is to make profits based on your analysis as well as by responding/adapting quickly to the market. Here are some main points of O'Neil

1. Buy exactly at the pivot point where a stock is climbing up to new high after a flat area in an upward direction.

2. Put the stop losses at 8%.

3.If stock increase, put more capital into it up to 5% past the inital buy point. For instance you bought a share of stock at $100. It has risen to $102 then you would put more money into it but when it reaches $105 then you should stop putting more money.

4.Once stock has risen 20%, sell it.

5.If a stock rises 20% in less than 8 weeks, hold it at least another 8 weeks. After that time period, make a decision to buy more or sell based on analysis and current price.

6. Focused portfolio. Concentrate on few winners than to have many small profits.

7.Make grudual move into and out of a stock. Buy a parcel of stock when it starts to rise and buy additional shares when it even goes furter. Opposite is true also. When your stock starts to decline, sell a parcel of it and completely get rid of it when the loss hits 8%.

8. Once bought, ignore the price you paid for each stock and cocentrate on each stock's performance.

9. Do not base your sell decision on your cost and hold the stocks that are down in price. Accept the fact you have made an imprudent selection and lost money.

C: Current quarterly earnings per share must be accelerating. When comparied to the same quarter from previous year, O'Neil wants to see increase in the current quarterly EPS. Bigger is always better. However, you must be careful not to be misled by a huge jump. For instance, a company's quarter EPS might have increased from $.01 to $.10, which is 900% increase but it is no better than increase from $.50 to $1 because the former is most likley to be distored and thus as not meaningful as the latter.

A: Annual EPS must be accerlating. Similar to "C", O'Neil wants to see each year's EPS increasing for the past five years. Preferably, the growth rate should be at least 25%.

N: New highs/something. O'Neil likes companies that have new products, services, management, or something that is postively contributing to the company. But more importantly, he likes stocks that are pushing to new highs. In here, we are talking about 52 weeks new high. Past 52 weeks, stock could've hit the low of $5 and high of $25. At the time when O'Neil buys the stock, the stock should be pushing to new high of $26.

S: Demand of stock should be greather than its supply. Supply and demand affect the price of everything including stocks. All other things being equal, stock with 50M shares oustanding is a better pick than a stock with 100M shares oustanding. You can compare to trading volume of stock and the number of shares outstanding to figure out the stock's supply and demand.

L: Leaders in an industry, AKA best relative price strength. Investor's Business Daily shows the relative price strength of stock, ranging from 1 to 99. Here if number is bigger, stock's performance is stronger so that means higher relarive price strength stock outperformed lower numbered stocks.

I: Institutional ownership must be moderate. As mentioned, demand is needed to drive stock price up. Institutional buying is one of the best source to measure stock's demand. Mutual funds, pention plan, banks and insurance companies are all institutional investors. O'Neil wants his stock to be owned by moderated number of institutions. If it's too small, that means demand is weak. That is not much of a problem. Perhaps, stock is undiscoverd yet and it has an opportunity to attract instituion and price will rocket soar. But on the other hand if stock is heavily owned by institutions then it may be over demanded. Moreover, if all the instituions reacts in the same way to negative news, they can dump a large number of shares and its price will plummet.

M: Market direction should be upward/positive. Even if you the greatest stock of all time, its price will probably decline if the market as a whore is doing poorly. Your stock might get back to its intrinsic value once market starts to recover but O'Neil is strictly a growth investor. In order to see the direction of market, O'Neil recommends watching the market average everyday. You can do so by following the daily price and volume of DJIA, SP500, NASDAQ and what not.

O'Neil believe in growth investing and completely ignores valuation models. He mentioned that cheap stocks are cheap for reasons and you get what you pay for. He basically does not care about P/E ratio. To him, relation between earning and price are irrelevant and should focus on earning acceleration itself. In addition, he believe in law of motion. This does not have anything to do with physics. N of CAN SLIM represents new highs of stock. He said, "What seems too high and risky usually goes higher and what seems low and cheaper usually goes lower." His firm's research back up his idea. According to it, stocks on the new high list tend to go higher while stocks on the new low list tend to go lower. Besides the stock price, O'Neil aggrees with Lynch that insider ownership and little debts are postive sign of stock.

Average down Vs. Retail Investment

O'Neil argues that investors should manage their portfolio as if they were managing retail store. On the shelf you have item A and B, if A sells better than B then what should you do? Obviously, put more As and get rid of Bs. This is retail investment: you buy more of what is working and sell off worse performers. In contrary, some investors do exactly opposite. They sell the better performers and add money to stocks that have fallen in price. This is not necessarily wrong. If you are very sure that your stock is undervalued and its price will drive back to the intrinsic value, you are buying the additional shares at a discount. But if your analysis is off by few dollars or so, you could be wasting substantial amount of money buying losers while your better performers are rocket soaring.

Automation of buying and selling

O'Neil likes to automate his transaction. By doing so, you are protected from emotional decisions. O'Neil places stop losses on his stocks, usually at 8%. Note that the stop losses should be applied to the new money invested in. For instance, if you initially bought 100 shares of stock at $10 then your total investment is $1000. It has risen 50% and then falls back to 40%. This necessarily may not be time to stop losses. Let us say that you add more money into it while the price is rising, O'Neil recommends stopping losses on that money if the stock slides back while keeping your inial investment money in the stock. So your stop threshold for the initial investment would be $9.2 while new stop loss for additional investment would be $13.8. O'Neil is an advocate of averaing up, also known as pyramiding. The plan is to move more moreny into your winners. O'Neil said, "Your objective in the market is not to be right but to make big money when you were right." This is simple but a powerful statement. When one of your stock picks declines and you sell it off because it hit the stop loss, you may not be valuing it correctly. The stock could be truly undervalued and its price may go up in the future. But what O'Neil is aruguing is that your job is to make profits based on your analysis as well as by responding/adapting quickly to the market. Here are some main points of O'Neil

1. Buy exactly at the pivot point where a stock is climbing up to new high after a flat area in an upward direction.

2. Put the stop losses at 8%.

3.If stock increase, put more capital into it up to 5% past the inital buy point. For instance you bought a share of stock at $100. It has risen to $102 then you would put more money into it but when it reaches $105 then you should stop putting more money.

4.Once stock has risen 20%, sell it.

5.If a stock rises 20% in less than 8 weeks, hold it at least another 8 weeks. After that time period, make a decision to buy more or sell based on analysis and current price.

6. Focused portfolio. Concentrate on few winners than to have many small profits.

7.Make grudual move into and out of a stock. Buy a parcel of stock when it starts to rise and buy additional shares when it even goes furter. Opposite is true also. When your stock starts to decline, sell a parcel of it and completely get rid of it when the loss hits 8%.

8. Once bought, ignore the price you paid for each stock and cocentrate on each stock's performance.

9. Do not base your sell decision on your cost and hold the stocks that are down in price. Accept the fact you have made an imprudent selection and lost money.

Friday, August 20, 2010

One up on Wall Street

Peter Lynch is an author of "One up on wall street." But he is more well known as a former manager of the Fidelity Magellan Fund, which was the world's largest mutual fund. During his tenure, Magellan outperformed 99 % of all stock funds growing from $20 million to $14 billion. One of the core strategies of his investment is "circle of competence." He insists to know the nature of business as well as industry before he makes an investment. There are a plenty of sources to get information. You can talk to employees, competitors, suppliers, etc. More importantly, you as a consumer have a pretty good idea of what products/services are superior than the others. Lynch found Taco Bell by eating a burrito on a trip to California. He found La Quinta by talking to people at the rival Holiday Inn. He found apple computer when his children insisted on owning one. As simple as it might look, a good investment could be nothing more than a good buy at Walmart.

Once he finds the company he wishes to invest in, Lynch likes to organize his picks into 6 different categories, which are

1. Slow grower

2. Stalwarts

3. Cyclicals

4. Fast grower

5. Turnaround

6. Asset plays

Here's the explanations for each.

1. Slow growers are usually large in size and older companies that used to be small but matured and have stable performance. Example would be utility companies like AT&T, Verizon, National grids. Their capital appreciation would not be much. In fact, it could move downward but they usually pay good dividends.

2. Stalwarts are large and old but they have not matured yet and are still growing. In 1988, Warren Buffer allocated $1 billion to invest in Coca-Cola. By that time, Coca-Cola was well established company and its stock price has risen fivefold in 6 years. In fact, it had risen over 500 folds since 1928. Many investors thought it was over priced and had no more spaces to grow. Yet its business expanded internationally finding new markets and successfully set its position as a global king of beverage. In this case, Coca-Cola is a classic example of Stalwarts.

3. Cyclicals are companies that are heavily affected by economy. If economy does well, so does the company, vice versa.

4. Fast growers are small young companies that grew at least 20% or more a year and have potential to become ever bigger. This is where a massive fortune or risks can be found. Although they are no longer fast growers, Starbucks, Iomega and the Gap were all fast growers who returned massive fortune to founding-investor who provided initial capital.

5. Turnarounds are internally good, solid companies that have been beaten down by external factors/markets. In the early 80s, Lynch bought Chrysler at $1.50 and it became 32 beggers.

6. Asset plays are companies with valuable resources that are not discovered by investors. Pebble beach in California and Alico in Florida owned valuable real estates that no investors paid attention. Later on, those real estate value rocket soared. Another example would be telecommunication companies 20-30 years ago. Asset plays are most likely to be new tech companies, who have intelligent ideas/product that have potential to be an industry leader.

Note that Lynch's classification is to know what you are buying. To set out to buy a stalwart or actively looking for fast grower might be very difficult. Once you make a decision to make an investment, use those categories to know nature of a company and know your expectation. If the stock you are buying is turnaround, you know that its stock is undervalued and you should not be concerned with market fluctuation because your expectation is that market will realize the intrincsic value of the company and will bring its price back to what it should be.

Lynch points out several compenents of a good company. First, simple business is better. Lynch emphasizes an importance of understanding the business before making an investment. If you own 10 different stocks in your portfolio and 9 out 10 have complex nature such medical related, bio-tech or computer engineering, you probably don't have in-depth knowledge about the business and industry. Knowing your company and industry vital to investment success.

In addition, Lynch likes companies that are overlooked by others. Everyone likes fancy, flash companies with new tech but then again all the bubbles busted in the early 2000s. Seven Oaks International is one of the most boring businesses you will ever find. It processes grocery store coupons. While everyone else is looking for new high tech companies, Lynch invested in Seven Oaks and its stock price rose from $4 to $33, impressive retrn of 725%. Think about Waste management, as the name implies the company manages waste which is a bit digusting to some investors. This company turned out to be 100 bagger.

Fast-growing companies are best inside slow growth industry if not no growth at all. This is no brainer. If your company is the one and only, who is rapidly growing while competitors are off the market then it is an obvious advantage. Such growth comes from having a niche. That niche can be anything from a quality product/services to excellent management. But one common characteristic that all niches share is its uniqueness. To have patents, trademarks, strong brand loyalty, companies have valuable niches that competitors do not and it drives the growth of company along with the increase in sales and profit.

Lych, like other investment masters, have his own way of protection against stock. He computes his margin of safety by subtracting cash per share from stock's current price. In 1988, Ford's stock was trading at $38 and its cash per share was $16.30. This means his margin of safety is 38-16.30, which is 21.70. Until the stock price goes down to $21.70, you can withstand the loss because you bought your stock at a discount. Also, Lynch points out importance of having a little debt. Long term debts are like deadly. It is overlooked in good time but when situation turns around, those debt strick the company hard.

Lynch recommends valuing stock price relative to company's value. In more detail, Lynch likes his stock P/E ratio equal to its earning growth rate. If a company's P/E 20 then he wants to see earning growth rate of 20%. If the growth rate is greather than the P/E then you have a bargain.

One other thing that Lynch mentions is insider/company buying the shares. Insiders such as employees and executives are the ones who are most knowledgable about the company. If they are buying shares, then you know at least the company won't go bankruptcy in next 6 months. Plus, those who buy stocks are partial owner of the company and they will likely to put more effort in their works because performance of company is directly related to their welfare. Note that while insidering buying is a good sign, insiders selling their stocks is not necessarily a bad sign. There are many reasons to sell stocks. Stock is an investment but before that, it is nothing more than a part of your property. If you wishes to buy a new car, have some expenses coming up for your college kids, or planning an exotic vacation, you can always sell your stock to get quick cash. But then again, there is only one reason buy stock: you expect it to go up.

One top of that, company buying its shares back can be seen a positive sign. If it is expecting a better performance in the future and have a plenty of cansh in its hand, it actually might be a good investment to buy its shares back. Note that those companies listed on stock market are legal entites. They are quite different from sole proprieties, partnerships and LLCs. They are separate legal entities from owners and can sometimes act as an individual investor. When a company buys its shares back, all things being equal, there are less number of shares outstanding for general public. A shortage in supply will cause the stock price to increase. Also, decrease in shares outstanding means increase in EPS. If a company buys back half of its shares while earning reamins the same then EPS just doubled.