Here are some characteristics of dollar weighted returns.

-It considers changes in investment

-Initial Investment is an outflow (money going out from your pocket)

-Ending value is considered as an inflow (money coming into your pocket)

-Additional investment is a negative flow (Again, money leaving your pocket)

-Reduced investment is a positive flow (Again, money coming back to your pocket)

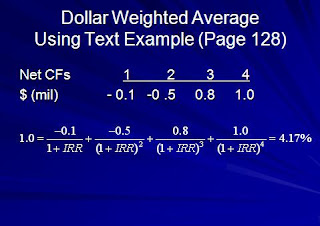

Dollar weighted return is nothing more than a IRR.

Internal Rate of Return (IRR) is the discount rate that results in present value of the future cash flows being equal to the investment amount.

Example

When you compute the IRR, this is the rate of return at which the net present value of project/investment is zero. In other words, if the internal rate of return exceeds the cost of financing the project, then the investment is profitable.

We can also approach it from NPV perspective.

NPV = Sum of CFt/ (1+ Rt)^t from period t=0 to n.

Whereas NPV = Net present value and CFt = Cash flow at time t.

When the rate of return is smaller than the IRR rate Rt then the investment is profitable (meaning NPV > 0 ). Otherwise, investment is not profitable.

IRR can also be a good measurement when considering multiple investment with a limited budget.

So if you have two different stocks in mind but only have a few hundred bucks then you would compute IRR and see which one has higher IRR.

However, there are some limitations with dollar weighted returns.

If cash flow changes from positive to negative or from negative to positive, IRR for investment cannot be calculated. Additionally, when you use IRR to evaluate multiple investment, result might indicate different ranking than NPV.

For instance NPVa = 50 and NPVb = 100 but IRRa = 5 % and IRRb = 3.6 %

In this case, NPV indicate that investment b is more profitable but IRR says a is better.

Which one should you choose?

If NPV and IRR give different result then NPV always rules over IRR. So investment b is superior.

This is because of IRR's weaknesses. First IRR uses single discount rate failing to accommodate changes in the rate. Second, IRR sometimes cannot be computed with mixture of positive and negative cash flow. And lastly, discount rate is sometimes unknown. You compare IRR to discount rate and then proceed to make an investment if IRR> discount rate. But if discount rate is unknown or cannot be applied for whatever reason then IRR does not work. On the other hand, NPV is inherently complex and requires assumption at each stage. If NPV > 0 then we know investment is worthwhile. This is why NPV is superior than IRR.

No comments:

Post a Comment