This blog is for myself and all others who want to learn about financial investment in general. While the focus of blog is on stocks, I would also like to cover: bond, derivative (options, swaps, future and forward), fund, currency, commodity, Treasury bill (risk-free)/bond, speculation, hedge, black-scholes

Friday, September 17, 2010

THE CAPM AND INDEX MODELS

Estimating the Index Model

Using historical data on T-bills, S&P 500 and individual securities

Regress risk premiums for individual stocks against the risk premiums for the S&P 500

Slope is the beta for the individual stock

Table 7.1 Monthly Return Statistics for T-bills, S&P 500 and General Motors

Figure 7.3 Cumulative Returns for T-bills, S&P 500 and GM Stock

Figure 7.4 Characteristic Line for GM

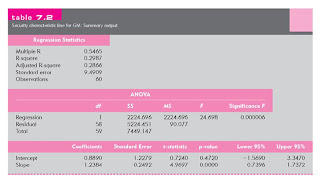

Table 7.2 Security Characteristic Line for GM: Summary Output

GM Regression: What We Can Learn

GM is a cyclical stock

Required Return:

rf + b(rm - rf) = 2.75 + 1.24x5.5 = 9.57%

Next compute betas of other firms in the industry

Predicting Betas

The beta from the regression equation is an estimate based on past history

Betas exhibit a statistical property

Regression toward the mean

Subscribe to:

Post Comments (Atom)

Thanks for explaining this concept!

ReplyDeleteShares to Buy