APR = annual percentage rate

(periods in year) X (rate for period)

EAR = effective annual rate

( 1+ rate for period)^Periods per yr - 1

Example: monthly return of 1%

APR = 1% X 12 = 12%

EAR = (1.01)^12 - 1 = 12.68%

This blog is for myself and all others who want to learn about financial investment in general. While the focus of blog is on stocks, I would also like to cover: bond, derivative (options, swaps, future and forward), fund, currency, commodity, Treasury bill (risk-free)/bond, speculation, hedge, black-scholes

Tuesday, August 31, 2010

Dollar weighted returns

Here are some characteristics of dollar weighted returns.

-It considers changes in investment

-Initial Investment is an outflow (money going out from your pocket)

-Ending value is considered as an inflow (money coming into your pocket)

-Additional investment is a negative flow (Again, money leaving your pocket)

-Reduced investment is a positive flow (Again, money coming back to your pocket)

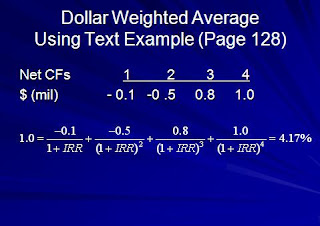

Dollar weighted return is nothing more than a IRR.

Internal Rate of Return (IRR) is the discount rate that results in present value of the future cash flows being equal to the investment amount.

Example

When you compute the IRR, this is the rate of return at which the net present value of project/investment is zero. In other words, if the internal rate of return exceeds the cost of financing the project, then the investment is profitable.

We can also approach it from NPV perspective.

NPV = Sum of CFt/ (1+ Rt)^t from period t=0 to n.

Whereas NPV = Net present value and CFt = Cash flow at time t.

When the rate of return is smaller than the IRR rate Rt then the investment is profitable (meaning NPV > 0 ). Otherwise, investment is not profitable.

IRR can also be a good measurement when considering multiple investment with a limited budget.

So if you have two different stocks in mind but only have a few hundred bucks then you would compute IRR and see which one has higher IRR.

However, there are some limitations with dollar weighted returns.

If cash flow changes from positive to negative or from negative to positive, IRR for investment cannot be calculated. Additionally, when you use IRR to evaluate multiple investment, result might indicate different ranking than NPV.

For instance NPVa = 50 and NPVb = 100 but IRRa = 5 % and IRRb = 3.6 %

In this case, NPV indicate that investment b is more profitable but IRR says a is better.

Which one should you choose?

If NPV and IRR give different result then NPV always rules over IRR. So investment b is superior.

This is because of IRR's weaknesses. First IRR uses single discount rate failing to accommodate changes in the rate. Second, IRR sometimes cannot be computed with mixture of positive and negative cash flow. And lastly, discount rate is sometimes unknown. You compare IRR to discount rate and then proceed to make an investment if IRR> discount rate. But if discount rate is unknown or cannot be applied for whatever reason then IRR does not work. On the other hand, NPV is inherently complex and requires assumption at each stage. If NPV > 0 then we know investment is worthwhile. This is why NPV is superior than IRR.

-It considers changes in investment

-Initial Investment is an outflow (money going out from your pocket)

-Ending value is considered as an inflow (money coming into your pocket)

-Additional investment is a negative flow (Again, money leaving your pocket)

-Reduced investment is a positive flow (Again, money coming back to your pocket)

Dollar weighted return is nothing more than a IRR.

Internal Rate of Return (IRR) is the discount rate that results in present value of the future cash flows being equal to the investment amount.

Example

When you compute the IRR, this is the rate of return at which the net present value of project/investment is zero. In other words, if the internal rate of return exceeds the cost of financing the project, then the investment is profitable.

We can also approach it from NPV perspective.

NPV = Sum of CFt/ (1+ Rt)^t from period t=0 to n.

Whereas NPV = Net present value and CFt = Cash flow at time t.

When the rate of return is smaller than the IRR rate Rt then the investment is profitable (meaning NPV > 0 ). Otherwise, investment is not profitable.

IRR can also be a good measurement when considering multiple investment with a limited budget.

So if you have two different stocks in mind but only have a few hundred bucks then you would compute IRR and see which one has higher IRR.

However, there are some limitations with dollar weighted returns.

If cash flow changes from positive to negative or from negative to positive, IRR for investment cannot be calculated. Additionally, when you use IRR to evaluate multiple investment, result might indicate different ranking than NPV.

For instance NPVa = 50 and NPVb = 100 but IRRa = 5 % and IRRb = 3.6 %

In this case, NPV indicate that investment b is more profitable but IRR says a is better.

Which one should you choose?

If NPV and IRR give different result then NPV always rules over IRR. So investment b is superior.

This is because of IRR's weaknesses. First IRR uses single discount rate failing to accommodate changes in the rate. Second, IRR sometimes cannot be computed with mixture of positive and negative cash flow. And lastly, discount rate is sometimes unknown. You compare IRR to discount rate and then proceed to make an investment if IRR> discount rate. But if discount rate is unknown or cannot be applied for whatever reason then IRR does not work. On the other hand, NPV is inherently complex and requires assumption at each stage. If NPV > 0 then we know investment is worthwhile. This is why NPV is superior than IRR.

Returns using arithmetic and geometric average

Arithmetic

rA = (r1 + r2 + r3 + ...rN) / N

rA = Arithmetic return

r1 = return 1, r2 = return 2, rN = return N, N = total number of returns

Example

rA = ( .10 + .25 - .20 + .25) / 4 = .10 or 10 %

Geometric

rg = {[(1+r1) (1+r2) .... (1+rn)]}^ 1/n - 1

Example

rg = {[(1.1) (1.25) (.8) (1.25)]}^ 1/4 - 1

= (1.5150) 1/4 -1 = .0829 = 8.29%

Note that arithmetic average works better when each number is independent whereas geometric is a better choice if numbers are dependent to each other.

For instance, lets say you are trying to calculate average for annual stock returns over fiver year period. Each year's stock return is not independent of past year's performance. If you incur loss in one year then you have less capital to generate return following year. For this reason, geometric average may give more accurate performance of your portfolio.

rA = (r1 + r2 + r3 + ...rN) / N

rA = Arithmetic return

r1 = return 1, r2 = return 2, rN = return N, N = total number of returns

Example

rA = ( .10 + .25 - .20 + .25) / 4 = .10 or 10 %

Geometric

rg = {[(1+r1) (1+r2) .... (1+rn)]}^ 1/n - 1

Example

rg = {[(1.1) (1.25) (.8) (1.25)]}^ 1/4 - 1

= (1.5150) 1/4 -1 = .0829 = 8.29%

Note that arithmetic average works better when each number is independent whereas geometric is a better choice if numbers are dependent to each other.

For instance, lets say you are trying to calculate average for annual stock returns over fiver year period. Each year's stock return is not independent of past year's performance. If you incur loss in one year then you have less capital to generate return following year. For this reason, geometric average may give more accurate performance of your portfolio.

Sunday, August 29, 2010

Risk and returns

We all know that risk and return have a direct relationship. If you want a bigger return then you must be willing to take additional risks that come along with it.

Let us see how to compute rate of return.

Holding period return for stock

HPR = (P1-P0+D1) / P0

Whereas P0=beginning price, P1= ending price, D1 = dividend

This return shows what % you earned during the stock holding period.

Example

Ending price = 24

Beginning price = 20

Dividend = 1

HPR = (24-20+1) / 20 = 25%

This is for a single period. In contrast when you want to measure return over multiple periods, you may need to measure how your investment performed over a preceding five-year period. Note that return measure is more ambiguous in this case.

Here's the example of multiple period return.

Let us see how to compute rate of return.

Holding period return for stock

HPR = (P1-P0+D1) / P0

Whereas P0=beginning price, P1= ending price, D1 = dividend

This return shows what % you earned during the stock holding period.

Example

Ending price = 24

Beginning price = 20

Dividend = 1

HPR = (24-20+1) / 20 = 25%

This is for a single period. In contrast when you want to measure return over multiple periods, you may need to measure how your investment performed over a preceding five-year period. Note that return measure is more ambiguous in this case.

Here's the example of multiple period return.

Tuesday, August 24, 2010

Leverage

In finance, leverage is any technique that is used to multiply gain or loss. Common usage of leverage is borrowing money to finance investment. For instance, let us say you bought 100 shares of stock A trading at $10. Total investment value is $1000. If the stock price increases from $10 to $15 then you have total investment value of $1500. So HPR would be (1500-1000)/1000 = .5 or 50 %. Now if you leverage your investment by borrowing money from your broker, return would be different. Let us say you borrow $1000 from Schwab and buy additional 100 shares at the same price $10 then you have total investment worth $2000. Again the stock price rises from $10 to $15. Here your total investment value becomes $3000. Subtract the borrowed fund $1000, which you will have to repay. Then you have final value of $2000. Your HPR would be (2000-1000)/1000 = 1 or 100 %. By borrowing half of your investment fund, you just doubled your return.

Case 1

100 shares at $10 = $1000 total

If stock price increases from $10 to $15

HPR = ($1500 - 1000)/ 1000 = .5 or 50 %

Case 2

100 shares at $10 = $1000

Additional 100 shares at $10 = $1000 ->borrowed fund from Schwab

Total investment value = $2000

If stock price increases from $10 to $15

HPR = ($3000 - 1000 - 1000) / 1000 = 1 or 100%

It is very important to acknowledge that leverage also works the same way in negative return. So that means if a half of your investment is leveraged then your profit or loss will be doubled. If stock price in the above declined from $10 to 5 then would have -50% return in the first case and -100% return in the second case.

Note that margin rate (interest you need to pay for borrowing fund) is not included in the calculation.

Leverage can be an excellent way to boost your return while it imposes a significant amount of risk. Shrewd investors must be careful using leverage and be willing to accept the risk that comes along.

Case 1

100 shares at $10 = $1000 total

If stock price increases from $10 to $15

HPR = ($1500 - 1000)/ 1000 = .5 or 50 %

Case 2

100 shares at $10 = $1000

Additional 100 shares at $10 = $1000 ->borrowed fund from Schwab

Total investment value = $2000

If stock price increases from $10 to $15

HPR = ($3000 - 1000 - 1000) / 1000 = 1 or 100%

It is very important to acknowledge that leverage also works the same way in negative return. So that means if a half of your investment is leveraged then your profit or loss will be doubled. If stock price in the above declined from $10 to 5 then would have -50% return in the first case and -100% return in the second case.

Note that margin rate (interest you need to pay for borrowing fund) is not included in the calculation.

Leverage can be an excellent way to boost your return while it imposes a significant amount of risk. Shrewd investors must be careful using leverage and be willing to accept the risk that comes along.

Monday, August 23, 2010

Gary Pilgrim

Gary Pilgrim is the manager of PBHG Growth, one of the top performing mutual funds. In similarity with O'Neil, he is a dynamic growth investor who puts lots of emphasis on earning momentum.

In order to avoid emotion affecting his buy/sell decision, he automates the process via using computer ranking system. First, system looks for the stocks that have increased their earnings by 20 % or more for two consecutive quarters. And then the system analyze if a stock has an upward earning estimate and positive earning surprise. Pilgrim is a number cruncher and barely visit his holding companies or have a meeting with the management team. His objective is to know how the companies are doing as opposed to what they are doing.

Pilgrim looks for high earning expectations and positive earning surprises. In other words, he likes company that analyst expect its earning to increase and have performed ever better than the expectation in past. Also, earning itself is not as meaning unless it has been growing over a period of time. Pilgrim looks at the rate of acceleration to figure out how rapidly company's earning has been growing. He wants to see a company's quarter earning greater than the earning from same quarter from a previous year.

In addition, Pilgrim pays a close attention to company balance sheet. In order to evaluate how company is managing its money, Pilgrim uses the BS as a reference and see if a company has what % of profit margin and $ value of debts.

Surprisingly, valuation models have no roles in Pilgrim's investment. Pilgrim mentions that P/E of 40 does not mean anything unless you look at the underlying growth characteristic of the stock. For instance, if a company has P/E of 20 but its earning growth rate is 25% then the stock is trading at a discount. He focuses entirely on growth factors when buying/selling stocks. Here, Pilgrim's view point of stock value equals to the expected value of net income. So it would something like S = E(NI). In contrary with O'Neil who stops loss at 8%, Pilgrim actually buys more of its stocks if its price decline but earning factors remain same. Ironically, that side of Pilgrim is somewhat similar to value investors because he withstand market volatility if he believes that stock is fundamentally undervalued.

Pilgrim once mentioned that growth investing may not be a good option for individual investors. That is, market fluctuate every second and so does the expected earning growth rates of companies. Professional analysts have thousands of $ worth access to information and they can keep the track of price movement and earning related news instantaneously. Whereas, individual investors have limited sources and it is a very time+effort consuming job. Pilgrim believes that investment success or failure submits to your own personal conviction and work habits. Because one method works for Pilgrim, it does not mean that very method will work for you. On the other had, there are a plenty of value investors who made successful investments while Pilgrim insists on growth investing. Hence, you must develop an investment strategies that best fit your objective and styles, which will reflect your believe and value system.

In order to avoid emotion affecting his buy/sell decision, he automates the process via using computer ranking system. First, system looks for the stocks that have increased their earnings by 20 % or more for two consecutive quarters. And then the system analyze if a stock has an upward earning estimate and positive earning surprise. Pilgrim is a number cruncher and barely visit his holding companies or have a meeting with the management team. His objective is to know how the companies are doing as opposed to what they are doing.

Pilgrim looks for high earning expectations and positive earning surprises. In other words, he likes company that analyst expect its earning to increase and have performed ever better than the expectation in past. Also, earning itself is not as meaning unless it has been growing over a period of time. Pilgrim looks at the rate of acceleration to figure out how rapidly company's earning has been growing. He wants to see a company's quarter earning greater than the earning from same quarter from a previous year.

In addition, Pilgrim pays a close attention to company balance sheet. In order to evaluate how company is managing its money, Pilgrim uses the BS as a reference and see if a company has what % of profit margin and $ value of debts.

Surprisingly, valuation models have no roles in Pilgrim's investment. Pilgrim mentions that P/E of 40 does not mean anything unless you look at the underlying growth characteristic of the stock. For instance, if a company has P/E of 20 but its earning growth rate is 25% then the stock is trading at a discount. He focuses entirely on growth factors when buying/selling stocks. Here, Pilgrim's view point of stock value equals to the expected value of net income. So it would something like S = E(NI). In contrary with O'Neil who stops loss at 8%, Pilgrim actually buys more of its stocks if its price decline but earning factors remain same. Ironically, that side of Pilgrim is somewhat similar to value investors because he withstand market volatility if he believes that stock is fundamentally undervalued.

Pilgrim once mentioned that growth investing may not be a good option for individual investors. That is, market fluctuate every second and so does the expected earning growth rates of companies. Professional analysts have thousands of $ worth access to information and they can keep the track of price movement and earning related news instantaneously. Whereas, individual investors have limited sources and it is a very time+effort consuming job. Pilgrim believes that investment success or failure submits to your own personal conviction and work habits. Because one method works for Pilgrim, it does not mean that very method will work for you. On the other had, there are a plenty of value investors who made successful investments while Pilgrim insists on growth investing. Hence, you must develop an investment strategies that best fit your objective and styles, which will reflect your believe and value system.

Sunday, August 22, 2010

How to make money in stocks

Willieam O'Neil is the founder of Invester Business Daily, which is a major competitor of the Wall STreet Journal. He also wrote a book called "How to make money in stocks," which represents his knowledge about growth investing. O'Neil has a sounding system/standard that he uses to screen out the stocks that meets his requirement. This system is known as CAN SLIM. It is an acronym for the attributes of companies/stocks that he considers to be investable. O'Neil emphasizes that a company must have all seven attributes in order to be considered for investment.

C: Current quarterly earnings per share must be accelerating. When comparied to the same quarter from previous year, O'Neil wants to see increase in the current quarterly EPS. Bigger is always better. However, you must be careful not to be misled by a huge jump. For instance, a company's quarter EPS might have increased from $.01 to $.10, which is 900% increase but it is no better than increase from $.50 to $1 because the former is most likley to be distored and thus as not meaningful as the latter.

A: Annual EPS must be accerlating. Similar to "C", O'Neil wants to see each year's EPS increasing for the past five years. Preferably, the growth rate should be at least 25%.

N: New highs/something. O'Neil likes companies that have new products, services, management, or something that is postively contributing to the company. But more importantly, he likes stocks that are pushing to new highs. In here, we are talking about 52 weeks new high. Past 52 weeks, stock could've hit the low of $5 and high of $25. At the time when O'Neil buys the stock, the stock should be pushing to new high of $26.

S: Demand of stock should be greather than its supply. Supply and demand affect the price of everything including stocks. All other things being equal, stock with 50M shares oustanding is a better pick than a stock with 100M shares oustanding. You can compare to trading volume of stock and the number of shares outstanding to figure out the stock's supply and demand.

L: Leaders in an industry, AKA best relative price strength. Investor's Business Daily shows the relative price strength of stock, ranging from 1 to 99. Here if number is bigger, stock's performance is stronger so that means higher relarive price strength stock outperformed lower numbered stocks.

I: Institutional ownership must be moderate. As mentioned, demand is needed to drive stock price up. Institutional buying is one of the best source to measure stock's demand. Mutual funds, pention plan, banks and insurance companies are all institutional investors. O'Neil wants his stock to be owned by moderated number of institutions. If it's too small, that means demand is weak. That is not much of a problem. Perhaps, stock is undiscoverd yet and it has an opportunity to attract instituion and price will rocket soar. But on the other hand if stock is heavily owned by institutions then it may be over demanded. Moreover, if all the instituions reacts in the same way to negative news, they can dump a large number of shares and its price will plummet.

M: Market direction should be upward/positive. Even if you the greatest stock of all time, its price will probably decline if the market as a whore is doing poorly. Your stock might get back to its intrinsic value once market starts to recover but O'Neil is strictly a growth investor. In order to see the direction of market, O'Neil recommends watching the market average everyday. You can do so by following the daily price and volume of DJIA, SP500, NASDAQ and what not.

O'Neil believe in growth investing and completely ignores valuation models. He mentioned that cheap stocks are cheap for reasons and you get what you pay for. He basically does not care about P/E ratio. To him, relation between earning and price are irrelevant and should focus on earning acceleration itself. In addition, he believe in law of motion. This does not have anything to do with physics. N of CAN SLIM represents new highs of stock. He said, "What seems too high and risky usually goes higher and what seems low and cheaper usually goes lower." His firm's research back up his idea. According to it, stocks on the new high list tend to go higher while stocks on the new low list tend to go lower. Besides the stock price, O'Neil aggrees with Lynch that insider ownership and little debts are postive sign of stock.

Average down Vs. Retail Investment

O'Neil argues that investors should manage their portfolio as if they were managing retail store. On the shelf you have item A and B, if A sells better than B then what should you do? Obviously, put more As and get rid of Bs. This is retail investment: you buy more of what is working and sell off worse performers. In contrary, some investors do exactly opposite. They sell the better performers and add money to stocks that have fallen in price. This is not necessarily wrong. If you are very sure that your stock is undervalued and its price will drive back to the intrinsic value, you are buying the additional shares at a discount. But if your analysis is off by few dollars or so, you could be wasting substantial amount of money buying losers while your better performers are rocket soaring.

Automation of buying and selling

O'Neil likes to automate his transaction. By doing so, you are protected from emotional decisions. O'Neil places stop losses on his stocks, usually at 8%. Note that the stop losses should be applied to the new money invested in. For instance, if you initially bought 100 shares of stock at $10 then your total investment is $1000. It has risen 50% and then falls back to 40%. This necessarily may not be time to stop losses. Let us say that you add more money into it while the price is rising, O'Neil recommends stopping losses on that money if the stock slides back while keeping your inial investment money in the stock. So your stop threshold for the initial investment would be $9.2 while new stop loss for additional investment would be $13.8. O'Neil is an advocate of averaing up, also known as pyramiding. The plan is to move more moreny into your winners. O'Neil said, "Your objective in the market is not to be right but to make big money when you were right." This is simple but a powerful statement. When one of your stock picks declines and you sell it off because it hit the stop loss, you may not be valuing it correctly. The stock could be truly undervalued and its price may go up in the future. But what O'Neil is aruguing is that your job is to make profits based on your analysis as well as by responding/adapting quickly to the market. Here are some main points of O'Neil

1. Buy exactly at the pivot point where a stock is climbing up to new high after a flat area in an upward direction.

2. Put the stop losses at 8%.

3.If stock increase, put more capital into it up to 5% past the inital buy point. For instance you bought a share of stock at $100. It has risen to $102 then you would put more money into it but when it reaches $105 then you should stop putting more money.

4.Once stock has risen 20%, sell it.

5.If a stock rises 20% in less than 8 weeks, hold it at least another 8 weeks. After that time period, make a decision to buy more or sell based on analysis and current price.

6. Focused portfolio. Concentrate on few winners than to have many small profits.

7.Make grudual move into and out of a stock. Buy a parcel of stock when it starts to rise and buy additional shares when it even goes furter. Opposite is true also. When your stock starts to decline, sell a parcel of it and completely get rid of it when the loss hits 8%.

8. Once bought, ignore the price you paid for each stock and cocentrate on each stock's performance.

9. Do not base your sell decision on your cost and hold the stocks that are down in price. Accept the fact you have made an imprudent selection and lost money.

C: Current quarterly earnings per share must be accelerating. When comparied to the same quarter from previous year, O'Neil wants to see increase in the current quarterly EPS. Bigger is always better. However, you must be careful not to be misled by a huge jump. For instance, a company's quarter EPS might have increased from $.01 to $.10, which is 900% increase but it is no better than increase from $.50 to $1 because the former is most likley to be distored and thus as not meaningful as the latter.

A: Annual EPS must be accerlating. Similar to "C", O'Neil wants to see each year's EPS increasing for the past five years. Preferably, the growth rate should be at least 25%.

N: New highs/something. O'Neil likes companies that have new products, services, management, or something that is postively contributing to the company. But more importantly, he likes stocks that are pushing to new highs. In here, we are talking about 52 weeks new high. Past 52 weeks, stock could've hit the low of $5 and high of $25. At the time when O'Neil buys the stock, the stock should be pushing to new high of $26.

S: Demand of stock should be greather than its supply. Supply and demand affect the price of everything including stocks. All other things being equal, stock with 50M shares oustanding is a better pick than a stock with 100M shares oustanding. You can compare to trading volume of stock and the number of shares outstanding to figure out the stock's supply and demand.

L: Leaders in an industry, AKA best relative price strength. Investor's Business Daily shows the relative price strength of stock, ranging from 1 to 99. Here if number is bigger, stock's performance is stronger so that means higher relarive price strength stock outperformed lower numbered stocks.

I: Institutional ownership must be moderate. As mentioned, demand is needed to drive stock price up. Institutional buying is one of the best source to measure stock's demand. Mutual funds, pention plan, banks and insurance companies are all institutional investors. O'Neil wants his stock to be owned by moderated number of institutions. If it's too small, that means demand is weak. That is not much of a problem. Perhaps, stock is undiscoverd yet and it has an opportunity to attract instituion and price will rocket soar. But on the other hand if stock is heavily owned by institutions then it may be over demanded. Moreover, if all the instituions reacts in the same way to negative news, they can dump a large number of shares and its price will plummet.

M: Market direction should be upward/positive. Even if you the greatest stock of all time, its price will probably decline if the market as a whore is doing poorly. Your stock might get back to its intrinsic value once market starts to recover but O'Neil is strictly a growth investor. In order to see the direction of market, O'Neil recommends watching the market average everyday. You can do so by following the daily price and volume of DJIA, SP500, NASDAQ and what not.

O'Neil believe in growth investing and completely ignores valuation models. He mentioned that cheap stocks are cheap for reasons and you get what you pay for. He basically does not care about P/E ratio. To him, relation between earning and price are irrelevant and should focus on earning acceleration itself. In addition, he believe in law of motion. This does not have anything to do with physics. N of CAN SLIM represents new highs of stock. He said, "What seems too high and risky usually goes higher and what seems low and cheaper usually goes lower." His firm's research back up his idea. According to it, stocks on the new high list tend to go higher while stocks on the new low list tend to go lower. Besides the stock price, O'Neil aggrees with Lynch that insider ownership and little debts are postive sign of stock.

Average down Vs. Retail Investment

O'Neil argues that investors should manage their portfolio as if they were managing retail store. On the shelf you have item A and B, if A sells better than B then what should you do? Obviously, put more As and get rid of Bs. This is retail investment: you buy more of what is working and sell off worse performers. In contrary, some investors do exactly opposite. They sell the better performers and add money to stocks that have fallen in price. This is not necessarily wrong. If you are very sure that your stock is undervalued and its price will drive back to the intrinsic value, you are buying the additional shares at a discount. But if your analysis is off by few dollars or so, you could be wasting substantial amount of money buying losers while your better performers are rocket soaring.

Automation of buying and selling

O'Neil likes to automate his transaction. By doing so, you are protected from emotional decisions. O'Neil places stop losses on his stocks, usually at 8%. Note that the stop losses should be applied to the new money invested in. For instance, if you initially bought 100 shares of stock at $10 then your total investment is $1000. It has risen 50% and then falls back to 40%. This necessarily may not be time to stop losses. Let us say that you add more money into it while the price is rising, O'Neil recommends stopping losses on that money if the stock slides back while keeping your inial investment money in the stock. So your stop threshold for the initial investment would be $9.2 while new stop loss for additional investment would be $13.8. O'Neil is an advocate of averaing up, also known as pyramiding. The plan is to move more moreny into your winners. O'Neil said, "Your objective in the market is not to be right but to make big money when you were right." This is simple but a powerful statement. When one of your stock picks declines and you sell it off because it hit the stop loss, you may not be valuing it correctly. The stock could be truly undervalued and its price may go up in the future. But what O'Neil is aruguing is that your job is to make profits based on your analysis as well as by responding/adapting quickly to the market. Here are some main points of O'Neil

1. Buy exactly at the pivot point where a stock is climbing up to new high after a flat area in an upward direction.

2. Put the stop losses at 8%.

3.If stock increase, put more capital into it up to 5% past the inital buy point. For instance you bought a share of stock at $100. It has risen to $102 then you would put more money into it but when it reaches $105 then you should stop putting more money.

4.Once stock has risen 20%, sell it.

5.If a stock rises 20% in less than 8 weeks, hold it at least another 8 weeks. After that time period, make a decision to buy more or sell based on analysis and current price.

6. Focused portfolio. Concentrate on few winners than to have many small profits.

7.Make grudual move into and out of a stock. Buy a parcel of stock when it starts to rise and buy additional shares when it even goes furter. Opposite is true also. When your stock starts to decline, sell a parcel of it and completely get rid of it when the loss hits 8%.

8. Once bought, ignore the price you paid for each stock and cocentrate on each stock's performance.

9. Do not base your sell decision on your cost and hold the stocks that are down in price. Accept the fact you have made an imprudent selection and lost money.

Subscribe to:

Posts (Atom)